Latest Automotive Industry News Review — 22nd May to 28th May 2017

We’ve just released our latest weekly review of automotive industry news and trends. You can find it here as a downloadable document.

Our favourite story this week? What about Ford? It was breaking news as we published last week that CEO Mark Fields was going to be replaced but now we’ve had the full suite of management appointments that come with it. We’ll be interested observers of Jim Hackett’s quest to reduce hierarchy and speed up decision making — and especially keen to see how the additional layer of management he’s added with the new roles for Farley, Hinrichs and Klevorn will help. The next Mulally or the next Nardelli? Only time will tell.

For all this and more, take a look at the pdf, or just read on…

Find our archive here.

SIGN UP FOR THE WEEKLY UPDATED TO BE EMAILED TO YOU HERE

Our latest research

We’ve published a post based on our research into the on-demand mobility business. It gives an overview of the various parts of the puzzle and sorts them into fact, forecast and fiction.

Company-by-company rundown

BMW

- There was renewed talk of a merger between car sharing companies DriveNow (BMW) and Car2Go (Daimler). The latest stories have a merger taking place in Q3 2017 and a new brand being established. Rumours of a tie up have circulated since December 2016. BMW’s partner in DriveNow, Sixt, has been openly opposed to the move but BMW reportedly now believes that it can convince Sixt to cooperate. (..)

- Issued a press release trumpeting its place as the third most popular employer, and most popular carmaker, for young German IT professionals. (..)

- Will recall over 45,000 2005 to 2008 year 7-series vehicles in the USA to fix faults with door latches. (..)

Daimler

- Announced it will be making €1 billion investment in battery production. €500 million of this is a new factory at Kamenz, Germany which will add about 500 jobs. (..)

- Daimler’s offices were raided by German prosecutors investigating possible misconduct in reporting diesel emissions. The raid was part of a previously announced investigation. (..)

- There was renewed talk of a merger between car sharing companies DriveNow (BMW) and Car2Go (Daimler). The latest stories have a merger taking place in Q3 2017 and a new brand being established. Rumours of a tie up have circulated since December 2016. BMW’s partner in DriveNow, Sixt, has been openly opposed to the move but BMW reportedly now believes that it can convince Sixt to cooperate. (..)

- Took a 15% stake in Hong Kong based dealer group LSH Auto International which operates about 200 locations in Asia and Australia. The financial terms were kept confidential. (..)

FCA

- Saw the US Department of Justice file a suit against it detailing various aspects of emissions control technologies that the EPA says that FCA failed to declare during certification for models dating back to 2014. The issues raised by the EPA are around the use of Exhaust Gas Recirculation (EGR) – a technology to help engines burn fuel more effectively and reach optimal operating conditions more quickly and Selective Catalytic Reduction (SCR) – a technology that uses a chemical (DEF / Urea / Ammonia) to treat NOx in exhaust emissions. The specific complaint is that the way in which FCA has configured the software to run over the conditions experienced in the test cycle is not representative of wider operating conditions and that FCA did not properly declare this during the certification process. (..)

Ford

- CEO Mark Fields retired and was replaced by former Steelcase CEO Jim Hackett, who has served as a Ford board member from 2013 to 2016 and been chairman of subsidiary Ford Smart Mobility LLC since 2016. At the same time as the appointment, Ford added a layer to its executive management team by announcing three newly created positions: Joe Hinrichs will become EVP, Operations; Jim Farley is EVP, Markets; Marcy Klevorn is EVP, Mobility. (..)

- Following on from the new CEO appointment and the creation of the new layer of executive management, Ford made a series of subsequent executive announcements. There will be new regional CEOs in North America, Europe, Middle East and Africa and Asia Pacific (only South America remains unchanged). The purchasing function will now become a part of product development and a new position of vice president for autonomous vehicles has been created. (..)

- Issued two safety compliance recalls in North America. In total about 3,000 F-series and Explorer vehicles are affected. (..)

Geely (includes Volvo)

- Zhejiang Geely (major shareholder in Geely Automotive, but not the HK listed company itself) reached a final agreement with Malaysian company DRB-Hicom on the sale of Proton stock. Under the deal, Zhejiang Geely will take a 49.9% stake in Proton and become the exclusive foreign strategic partner for the brand. It also obtains majority control of UK brand Lotus, with a 51% stake. (..)

- London Taxi Company announced a partnership with Chargemaster to provide at-home charging units for buyers of LTC’s new plug-in hybrid taxi. (..)

General Motors (includes Opel / Vauxhall)

- A class action lawsuit was filed in the US alleging GM had installed “defeat devices” in Duramax branded diesel vehicles since 2011. There is currently no suggestion from the EPA that GM did use defeat devices. (..). GM said that the claims were baseless and the company would “vigorously defend” itself. (More…)

- GM’s manager of vehicle and advanced technology policy said that companies that did not pursue collaborative solutions to on-demand mobility would have a “rude awakening”. (..)

Nissan

- Will reportedly sell its 51% stake in its Lithium Ion battery JV with NEC to Chinese private equity firm GSR capital for about $1 billion. (..)

PSA (excludes Opel/Vauxhall)

- Lost out in the bidding for Malaysia’s Proton and UK’s Lotus to Geely. (..)

- The sale of Peugeot Automobile Nigeria, with its 90,000 unit capacity plant, reached another milestone with the CEO if AMCON (the seller) saying that only central bank approval was needed to complete the sale to Aliko Dangote. (..)

Renault

- Agreed a deal to take over some of Intel’s French research and development activities. Intel has five R&D sites in France and announced in mid-2016 that it would sell or close all of them. Renault will take on two sites: Toulouse and Sophia Antipolis, with about 400 employees. (..)

Tata (includes JLR)

- Reported Q1 2017 financial results for the total Tata Automotive business. Revenue was down year-over-year, due to lower sales of Tata branded vehicles and weaker GBP impact on JLR sales (even though JLR’s GBP revenues were up). Profit was also down, reflecting higher sales but also higher costs at JLR (along with weaker sterling) and lower sales of Tata commercial vehicles, partially offset by passenger car growth. (..)

- JLR reported full year results (its financial year runs to the end of March). Wholesales of 604,009 units were a new record, up 16% year-over-year. Full year revenue of £24.3 billion was up 9% YoY, pre-tax profits of £1.6 billion were up 3% YoY. (..)

- The European Commission announced that it will look at whether state aid rules were breached in agreeing a €125 million support package for JLR’s Slovakia plant. JLR denies that there is any violation of the rules. (..)

Tesla

- Following Tesla’s recent press release of the steps it takes to manage worker safety, a report by Worksafe (a California not-for-profit) said that the company’s accident rate and lost time due to accidents was higher than industry average. Tesla have argued that their safety record is improving. (..)

- CEO Elon Musk tweeted his excitement about the next Autopilot software release. He said that the new control algorithm feels “as smooth as silk”. (..)

- Saw Consumer Reports reinstate some of the points it docked Tesla after Autopilot 2.0’s emergency braking system proved less capable than earlier versions. Tesla still needs to get the system operational at highway speeds to see its Consumer Reports rating returned to the same level it had before Autopilot 2.0 was released. (..)

Toyota

- Said that it was exploring the use of blockchain technology to securely store autonomous vehicle driving data from multiple sources. The system Toyota is developing is aimed at improvements in three areas: holding test data, usage based insurance and transacting feeds for car or ride hailing. (..)

VW Group

- Said that it had increased its goal for environmental impact reduction. Instead of the prior target of a 25% drop in key measures of pollution from 2010 levels, VW will now aim for 45% by 2025. (..)

- CEO Mueller said that changing the company’s culture was proving tougher than expected. (..)

- French media reported that in a worst-case scenario, the French judicial investigation in aggravated deception by VW in relation to the diesel scandal could result in fine of almost €20 billion. The same report concluded that the fine should be proportionate to the benefit of the fraud. (..)

- VW has received formal approval for a joint venture with Anhui Jianghuai Automobile Group (JAC Motor) specialising in electric vehicles. This paves the way for a joint venture contract between the two. (..)

Other

- Aston Martin reported its Q1 2017 Financial results. Revenue of £188 million was more than double the prior year’s level. Wholesales of 1,200 units were up 75%. The company reported a profit before tax of £5.9 million for the quarter, ending a run of losses. The full year EBITDA forecast of $170 million indicates that AML expect the performance to continue through the rest of the year. (..)

- Maruti Suzuki will partner with Dena Bank to offer retail financing for new vehicle sales in India. (..)

- Mahindra and Mahindra said that it was looking to launch a new electric vehicle in the second half of 2019 and may look to raise funds. (More…)

- Subaru’s CEO gave an interview where he commented that the company was still not sure whether to have a dedicated EV, or simply make it a powertrain option in existing vehicles. The company has committed to bring an all-electric vehicle to market by 2021 (PHEV in 2018). (..)

- Chinese carmaker Great Wall will develop self-driving and electric vehicle technology with Japanese chipmaker Renesas Electronics. (..)

And now for the other news…

Economic / Political News

- German chancellor Angela Merkel said that the country must invest in order to keep up in electric cars and that it was important that electric mobility was ready as quickly as possible. She made her comments at the announcement of Daimler’s new battery factory, (..)

- EU commercial vehicle registrations were down 7.2% year-over-year in April, blamed on Easter. On a year to date basis, CV registrations are up 3.8% although performance is mixed across markets. (..)

- UK trade body the SMMT reported April 2017 production. Car output was down 18.2% year-over-year. CV output fell 28.3% YTD. Fewer working days due to Easter was blamed for the fall. Car production YTD is up 1% (More…) and CV production is down 8.1% YTD. (..)

- Spanish vehicle production has fallen 3.9% on a January to April basis. Fewer workdays due to Easter was cited as a major cause. (More…)

Suppliers

- Saw media report on the attempt by plaintiffs in the GM class action lawsuit to link the various carmaker diesel scandals to Bosch. (..)

- Plastic Omnium said that its Automotive Strategic Advisory Committee, formed in 2011, would now add external members to help speed up the company’s innovation efforts. (..)

- Bavaria’s minister of economic affairs criticised the shareholder battle at Grammer. (..)

Rental, Ride-Hailing & Car Sharing

- Uber wrote a blog post announcing some changes to the algorithm of its POOL service in New York. Amongst the changes, passengers will now be picked up and dropped off at what Uber determines is the most efficient point, rather than exactly where they asked. (..)

- Brazilian ride sharing app 99 (aka 99taxis) said that it had $100 million from SoftBank, taking its latest funding round to $200 million. Most of the remainder came from Didi. (..)

- There was renewed talk of a merger between car sharing companies DriveNow (BMW) and Car2Go (Daimler). The latest stories have a merger taking place in Q3 2017 and a new brand being established. Rumours of a tie up have circulated since December 2016. BMW’s partner in DriveNow, Sixt, has been openly opposed to the move but BMW reportedly now believes that it can convince Sixt to cooperate. (..)

- Avis Car Rental is increasing the number of connected cars it has in the fleet — to more than 50,000 by early 2018. (..)

- A ban on Uber’s services in Italy (suspended pending appeal) was overturned by a higher court. (..)

- Uber said that it had over-charged drivers in New York by failing to calculate commissions properly. (..)

- Media profiled Los Angeles ride sharing start-up RideYayYo. The company provides drivers with cars free of charge. (..)

- Paris public transport operator RATP is investing in the Paris operations of car sharing company Communauto. (..)

- Europcar Group has agreed a deal to acquire German rental company Bunchbinder. Bunchbinder currently has 152 sites and around 20,000 vehicles. (..)

Driverless / Autonomy

- A UK survey of consumer opinions on driverless cars found that OEMs were perceived as more trustworthy than tech firms — an earlier US study had indicated the opposite. Over half of those surveyed believe that autonomous vehicles will be widely available within the next 10 years. (..)

- Researchers at the University of Michigan (under the banner M City) published a white paper saying that they believed they had a method to dramatically reduce the time it would take to certify the safety of autonomous vehicles. Their method uses real world data and a computer model to build a random but comprehensive test cycle for the vehicle to accomplish. (..)

- Chinese carmaker Great Wall will develop self-driving and electric vehicle technology with Japanese chipmaker Renesas Electronics. (..)

- Toyota said that it was exploring the use of blockchain technology to securely store autonomous vehicle driving data from multiple sources. The system Toyota is developing is aimed at improvements in three areas: holding test data, usage based insurance and transacting feeds for car or ride hailing. (..)

- Innoviz announced that it will release an aftermarket LIDAR product that can be used for self-driving vehicle development. The product called InnovizPro will be able to collect and analyse data that should be representative of later mass produced products such as the InnovizOne (set for release in 2019). (..)

Electrification

- The creator of the Streetscooter electric delivery van intends to put an electric city car into production in 2018. The vehicle will be called “GO Life” and will be produced in the Aachen factory alongside Streetscooters. (More…)

- Subaru’s CEO gave an interview where he commented that the company was still not sure whether to have a dedicated EV, or simply make it a powertrain option in existing vehicles. (..)

- Chinese conglomerate LeEco announced that the CEO would step down and it would have to make layoffs in the US as it attempted to save money. (..)

- Employees at Faraday Future were told that the problems at LeEco would not affect them (LeEco is a major backer). (More…) Separate reprots said that the company needed $1 billion in new investment to continue (More…)

- A Bloomberg New Energy Finance report said that electric vehicles would reach cost parity with gasoline engine cars by 2026. (..)

- Analysis by UBS said that by 2025 14% of global sales and one third of European sales would be BEV or PHEV. (..)

Other

- UK used car values (3 years / 60,000 miles) declined by 1.5% in May. Industry experts attributed this to both a surplus of stock and seasonal factors, pointing to a similar dip in May 2016. (..)

- A profile of start-up Blippar claimed that the company’s technology can recognise (with 97.7% accuracy) any make, model and year of US made car from 2000 onwards as long as the vehicle is travelling below 15 mph. (..)

- Nexar and the Nevada Center for Advanced Mobility have formed a partnership that will launch a vehicle-to-vehicle network covering Nevada. The partnership hopes to be collected 250 million miles worth of data each week by 2020. (..)

Driverless On-Demand Mobility: Fact, Forecast And Fiction

It’s cool that the possibility of widespread availability of driverless vehicles creating on-demand mobility services has caught the imagination over the past couple of years. Many exciting visions of the future have been shared and lots of amazing gadgetry has been demonstrated.

When it comes to what the future holds, two camps have emerged. On the one hand, there are the optimistic futurists who see robo-taxis for all by 2030 as a statistical certainty. On the other, the world-weary sages who say it will all be a lot later and develop in a far more boring way. Worryingly, this splits along party lines: the tech industry in the avant-garde corner whilst the car industry bides its time, muttering something about having seen it all before. Strangely there aren’t that many people in the middle.

After researching the way people travel and the possibilities for on-demand mobility, it seemed appropriate to write a first principles analysis and provide more facts into the debate…

A presentation with an overview of the research is here

The full fat version is here — it’s 20,000+ words but we promise you’ll learn from reading it

Firstly, beware of single point forecasts (the kind that say “for certain, by 2030 driverless cars will have X% of the market share”). These are scenarios. They are fine for headlines but dig into the detail and very little is concrete. It is more a case of if… driverless cars are good enough and if… regulators allow them free rein and if… people are happy to travel in them because there aren’t any death-trap early experiences. No one knows exactly how this will develop or how fast. If they do, they are from the future. And if they came from the future would they really be writing about the automotive industry rather than relaxing on a beach with their lottery winnings (or maybe being Elon Musk)? This does not mean that any given forecast is certainly wrong. It means you should view them as the author’s preferred scenario. It won’t necessarily happen like that.

We’ve sorted the facts, forecast and fiction to help you develop your own scenarios.

There are a few certainties about driverless cars:

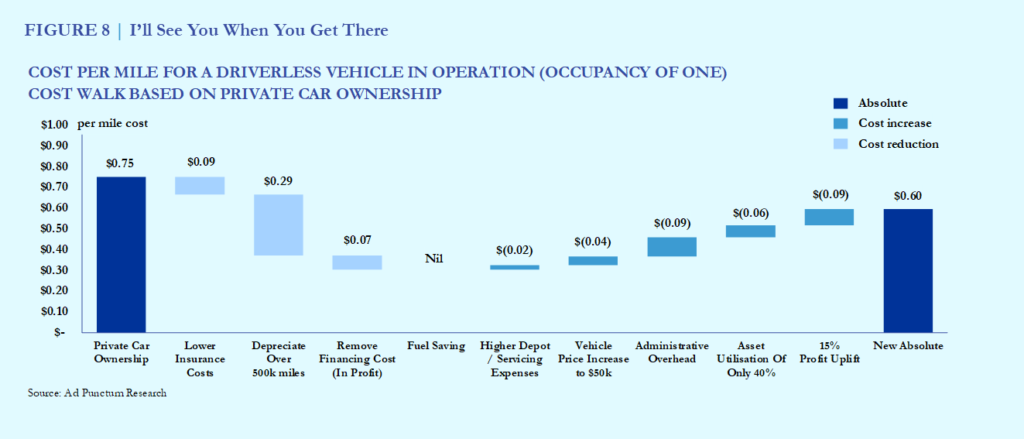

- Using a driverless car as a taxi will become cheaper than owning a car. Once the artificial intelligence gets sorted out, whether that is 2020, 2030 or 2040, driverless taxis will have a clear cost advantage. The reason is that we all leave our cars parked up in the sun, rain and snow for nearly 23 hours a day on average. Driverless cars can be in use 8 to 10 times more than that (that’s about the limit unless we change our travel habits). The cost doesn’t drop by a factor of 10 because much of it is mileage based but there is enough of a reduction that a taxi operator can cover the overhead of running a car service, make a profit and still charge you less than your car would cost to run.

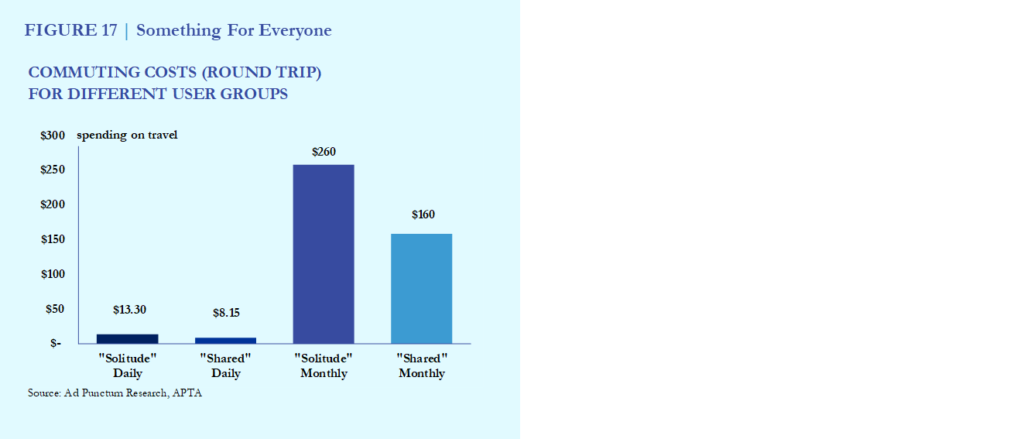

- You don’t have to share a robo-taxi for it to be cheaper than a private car, you only have to share robo-taxis if you want it to be cheaper than public transport. Some people are put off by the notion of “shared” mobility and having to rub shoulders with strangers, but that needn’t be the case. If you want to travel on your own then you can do so. You’ll pay more than people who share but less than owning your own car. People who share will pay less than public transport, get a door-to-door service and travel alongside fewer strangers than if they took the bus or metro.

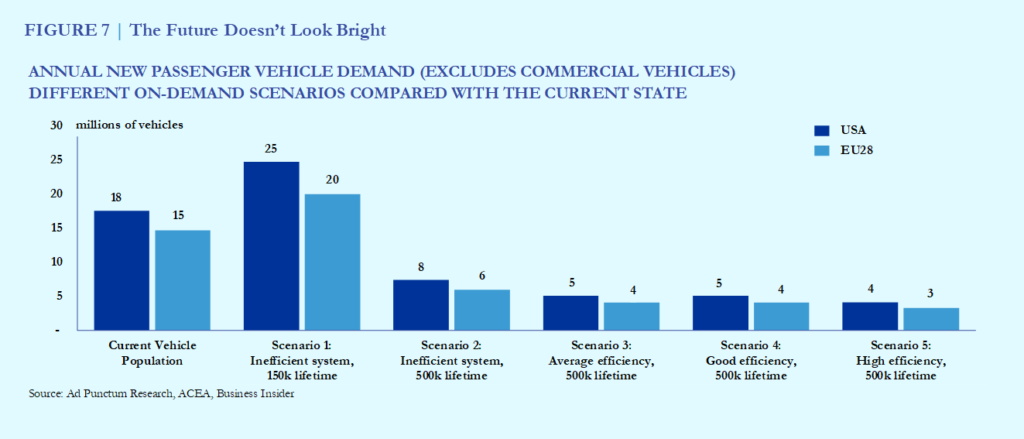

- Widespread use of robo-taxis would mean far fewer cars were needed. Since this is about stating the facts, we must choose our words carefully. A system that uses the same vehicle to serve multiple customers throughout the day needs a smaller number of vehicles than there are at present, that is a fact. This is not a cast iron guarantee that new car production is reduced — but it is certain that older vehicles (which outnumber new ones by more than 10:1) would no longer be required (apart from for posterity purposes of course). Whilst not guaranteed, it is very likely that new car production would decline. The only scenario in which it would not involves very low vehicle lifetimes and low utilisation rates.

- Robo-taxis will reduce road accidents and deaths by a massive amount. The forecast is a 90% reduction. Once you start looking at the technology, it’s not hard to see why. The sensors can see a phenomenal amount, in all directions, over long distances. Looking at the track record of humans, things become even more clear. The UK Department for Transport collects road accident data about how the vehicle was travelling when the accident occurred. 50% of them take place whilst the driver is going in a straight line. That’s right, we’re worried about whether robots can drive yet half our accidents come when all we have to do is hold the wheel steady and not crash.

- The electronics are going to be cheaply available very soon. Although there are questions over how quickly the artificial intelligence (decision making part of the car) will mature, the sensors (the bits that see the surroundings) will be ready for 2020 and be relatively cheap (around $5,000 or possibly even less).

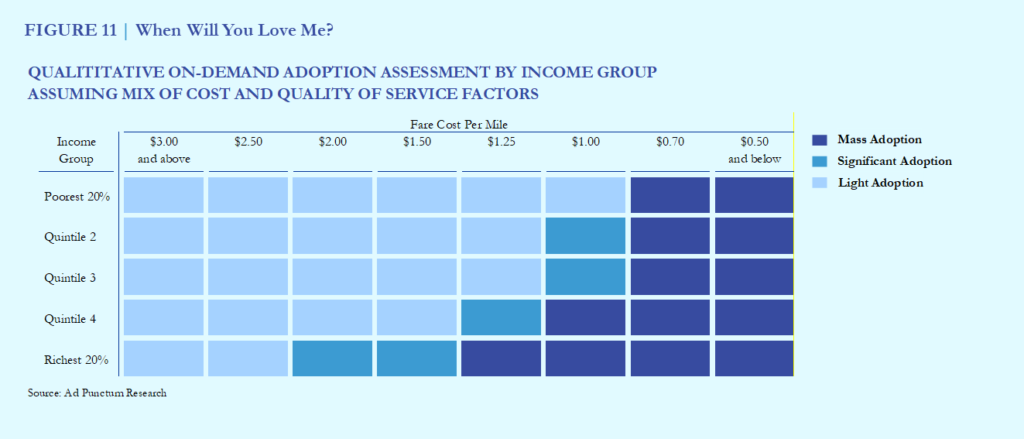

- Being cheap matters. There is plenty of academic research about how price sensitive people are when it comes to travel and the answer is: a lot. There is a big difference in the amount that the richest and poorest groups travel on the road (far flung holidays come on top of that), even in rich countries. Only the wealthiest 40% can afford to switch simply based on luxury (a robotic chauffeur) and the value of time and effort saved. The rest will find it appealing in concept but wait until the price is right before hopping aboard.

- A driverless car is still a car. The artificial intelligence bit is super cool but it only covers a narrow range of activities — it will drive and maybe try to monitor your facial expressions; changing the music and mood lighting accordingly. That’s it. The rest of the experience is all traditional car. Is it quiet inside? Is the seat comfortable? Is the ride bumpy? Was that the door handle that just came off in my hand? Technology companies can’t deliver a full turnkey solution without the help of car companies (which can be expanded to include Chinese manufacturers and others such as Magna). Car making is hard. Car making is so hard that there are only two surviving new western car makers in the last three decades — Tesla and McLaren — and neither of them have sold over 100,000 cars a year yet or managed to profitably produce a car that costs less than $80,000 (Model 3 fanboys take note: I said “yet”). Car making is so hard that even though Elon Musk has a company that worked out how to make rockets land on ships, he still frets about getting Model 3 dashboards bolted in efficiently. Please no Fix-It-Again-Tony puns… The fact is that Fiat can sell you a Panda that carries five people at highway speeds and protects them in a crash for the same price as a couple of high end televisions. If someone does a car where the driverless part is amazing but the car bit is rubbish, customers will quickly grow weary. These products must be well executed in every way — the first driverless cars are ambassadors for a whole new mode of transport. Successful solutions will have deep involvement from a car maker.

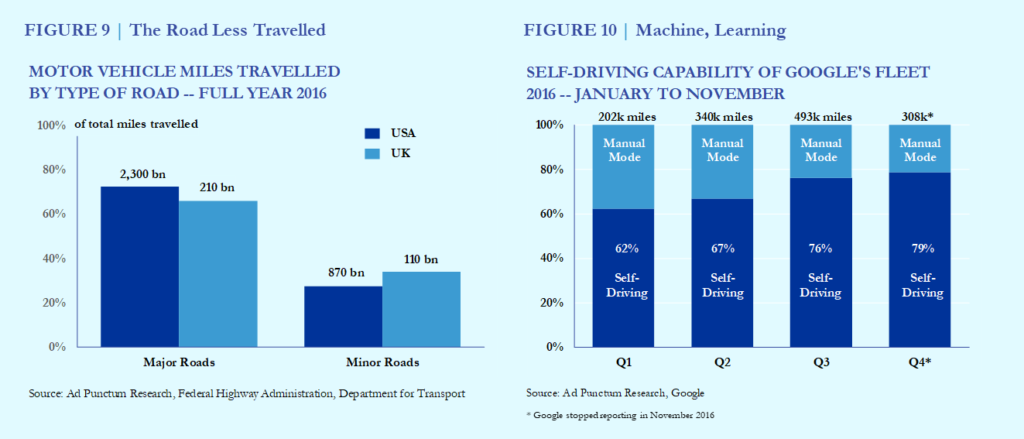

- Driverless car capability is already quite high. Most miles are travelled on the easiest road types — the kind of journeys that Tesla’s Autopilot has already gingerly ventured into. Today, more than 60% of road travel is on major roads and highways. Driverless vehicles don’t have to be capable of navigating streets filled with grannies chasing ducks in order to cover most of the journeys that humans take.

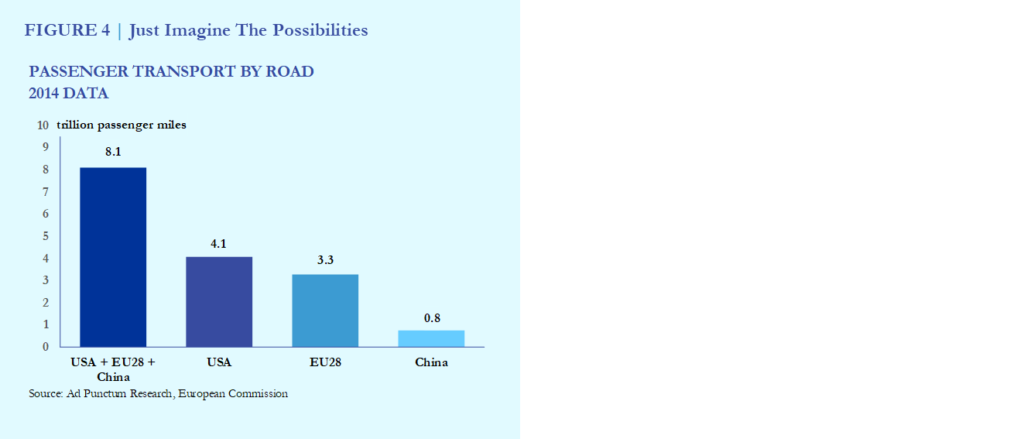

- There is a massive market out there. Humans travel trillions of miles each year on the roads. Even if robo-taxis didn’t dominate but managed to get a market share measured in the tens of percentage points then it could be hugely lucrative — and far bigger than the taxi business is today at about 1% of miles travelled.

- Travel is going to grow, with or without on-demand mobility. Although it isn’t directly correlated with GDP growth, miles travelled on the road have grown over time and that trend is forecast to continue even with traditional car ownership. In 30 years’ time, the market will probably be somewhere between 20% and 50% larger than today, regardless of the technological changes.

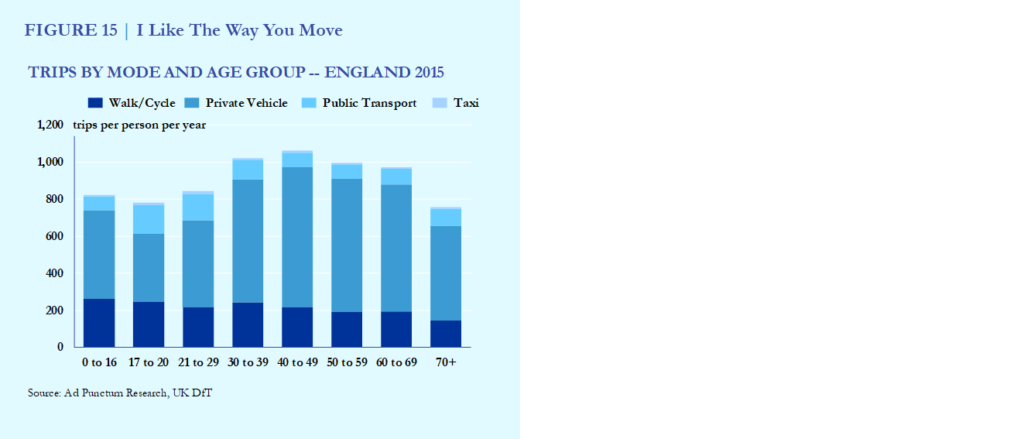

- Some markets are underserved today. Whether you look at the UK or the US, about 10% of the population have restricted mobility (across age groups). These people travel only half as much on average than everyone else (very few people are completely house-bound). There are very real use cases where cheap, driverless services can help individuals travel more and make a big difference to their lives.

Erm, that’s it for the hard facts. Notice how little that tells us about the timeline. It is solid evidence of driverless mobility being amazing at some point, but not when we can expect it.

Here is what we don’t know, and until we know it we won’t know the timing and when we know it, it will be because it already happened:

- What will the customer think? Widespread usage of robo-taxi services requires two changes in customer behaviour. The first is to be okay with being driven around by a machine. The second is to be okay with subscribing to a service that provides a taxi whenever you need it instead of owning a car. We don’t yet know how receptive people will be to either, certainly in the mainstream. Surveys at the moment say many are wary of driverless cars (but they haven’t actually experienced them) and in the year 2000, 4% of Americans believed Elvis was still alive, so what does any of that tell us?

- How willing will regulators be to let the vehicles onto the roads in the first place? It will probably vary across the globe. Some will be encouraging, whilst others will be more conservative, perhaps even hostile. Currently, there isn’t even widespread agreement to free running of test fleets — despite the presence of “safety drivers” hovering over the steering wheel. Optimistic forecasts assume that the regulators are compelled by the safety and business case. That may or may not be true, as Saudi Arabia’s ban on women driving and places where you can ride a motorcycle without a helmet attest. The counter argument? These are outliers. The counter-counter argument? These are outliers more than 100 years after the introduction of private cars. When cars were first allowed on the roads in Britain they famously had to be preceded by a man with a flag. Some regulators will take inspiration from that.

- How much will regulators let the free market rule? The implicit assumption by many today is that driverless mobility will be a no-holds-barred battle of technology and business nous. The victor will be bequeathed an unparalleled monopoly over travel. This vastly misjudges how most regulators — and the governments that appoint them — think and work. Driverless vehicles are a matter of safety and public transport. How many regulators will allow a situation where your chances of death are significantly higher if you use the RobGo service rather than RobDrive? Will they demand that transparent standards are set, followed and available to all for a nominal royalty payment or will they be comfortable with safety-critical technology being proprietary IP? Why would they allow travel monopolies to develop when the markets in energy, media and telecommunications are heavily policed for anti-competitive measures? Approaches will vary, and with them, growth rates. We simply don’t know whether the biggest markets will have the best or worst conditions for growth. In case you doubt the capability of regulators to enact whimsical solutions, just remember that there are cities where you can only drive in on a given day if you have the correct digits on your registration plate.

- How long does it take artificial intelligence to learn new roads? There are two parts to this question: the first is how long it takes before the artificial intelligence thinks it knows the road, the second is how long it takes for regulators to trust it to use those roads. Elon Musk thinks six billion miles will be sufficient to convince regulators (Toyota think 8.8 billion, including simulation). If Musk is right, then that is less than 0.2% of road travel in the USA each year. It’s high compared to the number of driverless cars on the roads at present but a figure that would be quickly achieved with the right size of fleet in future. There’s an implicit assumption in those statements that approval is a one-time event: will regulators then allow companies to decide for themselves that they are capable on a new road or will they want more oversight?

- How will the legal framework develop? The fear is this: robo-taxis inevitably crash, the victims sue the faceless corporation that operates them for negligence and win big, bankrupting them. The truth may be more complex. When the manufacturer is hauled before the courts, they will apologise for the outcome but point to the accident rate of their technology being one-tenth that of a human taxi driver. Lawyers will demand that their client be treated as if they are an exceptional driver who made a mistake rather than a wilfully negligent industrial behemoth. Judgements will be completely inconsistent across the globe. In some countries, lawmakers will develop frameworks that can be followed, others will rely on case law. The less coherent the legal conditions, the fewer robo-taxis on the road, but there will likely always be some prepared to test the “guilty but normally better at driving, Your Honour” argument. Even with a 90% better accident rate than humans, thousands may perish in robo-taxi crashes each year. Plenty of court appearances await.

- How much money is there out there to fund these new fleets? Our analysis is that a fleet of vehicles covering the needs of the US population would cost up to $2.5 trillion to build from scratch. Then there will be an on-going bill to renew the fleet. This means that to have rapid growth, one or more of the following conditions must be met: (1) Hundreds of billions of upfront funding to buy the fleets or; (2) massive customer demand, unchecked by the inevitable accidents, means that robo-taxis operators make massive profits before the inevitable price war or; (3) someone has created an upgrade kit that means conventional cars can be converted into driverless taxis quickly and cheaply and the initial fleet can be created from a motley crew of purpose built and re-purposed cars.

- What type of vehicle will robo-taxis be? Is it the same as the cars private consumers buy with a few extra parts bolted on to make it autonomous or is it purpose-built an industrial owner wanting to sweat the asset? Some say the former because it gives car makers more flexibility, some say the latter because it optimises the business case. There is a trade-off. If a retail-esque vehicle is used, then they will be wearing out after less than two years. That seems like a lot of money to send to the scrapheap. If they are purpose-built then they will have separate designs, components and assembly machinery (advances in manufacturing engineering and platform commonality notwithstanding).

- The cars are probably electric but does that even matter? Many researchers are coming to the same conclusion — it makes sense for driverless vehicles operating a taxi service to be electric. It offers the following advantages: longer vehicle life; quieter and smoother customer experience and; regulatory blessing (look how clean I can make your city). What isn’t so clear is whether this is a differentiating factor versus private cars.

- How fast do costs come down? Suppliers are already talking about a technology cost of around $5,000 in 2020. This means that the vehicle manufacturer will likely want to charge the end customer somewhere in the $7,500 to $10,000 range. But how quickly does the cost come down? Some forecast $1,000 by the late 2020s. The outcome will be heavily based on technology and volume development. Cost reductions probably don’t make or break the business case. If a car lasts for 500,000 miles (as a New York taxi does today) then the difference between a $1,000 and $10,000 technology cost is under $0.02 per mile.

- How quickly does production capacity increase? If there is demand for driverless vehicles then production capacity will rise but that doesn’t ensure production capacity rises in line with growth in demand from operators. Some forecasts assume driverless vehicles arrive in 2020, quickly prove their worth and then usage takes off. Whilst possible, this doesn’t seem to be the industry’s planning assumption. Although vehicles will be available around 2020, no manufacturer aside from Tesla is saying that these will be in mass production quantities. It takes manufacturers the best part of five years to bring a new product from a blank sheet of paper to production at scale. Ignore their PR teams telling you otherwise. Even if the initial test fleets show great promise for driverless mobility therefore, manufacturers may struggle to deliver volume before mid-decade.

- Will there be an explosion in travel as road movement becomes cheaper and more relaxing? The advent of on-demand driverless transport will mean big gains for the individuals with restricted mobility (see facts), but at a population level, the effect is less significant — probably around 5% growth in total travel. Explosive growth of new markets (some talk of 40%+ increases in miles travelled) requires a fundamental change in behaviour. Quite possibly those forecasting huge growth will end up being right for the wrong reasons: organic transport growth will mean a rise in miles travelled that would have happened even if we were still using “dumb” cars.

- Will robo-taxis clean up our streets or create nightmare traffic jams? There seem to be two opposite opinions here. The first is that with fewer cars, which are on the move more of the time, there will be less need for parking (true) and that space will given over to the public and filled with (developers may have other ideas). The second is that autonomous cars will cause an explosion of miles travelled, resulting in a gridlocked hellscape beyond our worst fears (Malthus would applaud but given how much travel has increased in the last century, it seems that cities and humans can cope).

- How will autonomy impact freight delivery? Presently, about 50% of freight volume travels on the road (as opposed to rail and pipeline). Removing the driver of a heavy goods vehicle will yield savings, but at a $/tonne level (it will be cents per package). Removing the driver of local delivery vehicles would have a more significant impact on the customer’s wallet. This is dependent on new solutions for getting the package safely into the home without a delivery person involved.

Each of the points above have variability which would prove positive or negative for robo-taxi growth. Divining a single timeline is a challenge. Steady growth is about various forces (operators, customers, regulators, investors and manufacturers) finding a favourable equilibrium — likely to be easier in some locations than others.

Here is what we won’t see — or if we do it’s because on-demand mobility becomes a business that defies known laws of commerce in new and special ways.

- Vertically integrated solutions won’t last in the long term. Almost everyone seems to be planning on doing everything (except perhaps for Google, Lyft and FCA). The vertically integrated narrative is this: Companies will design and manufacture driverless vehicles. They will sell them to a subsidiary that owns and operates a fleet for rental on a per-ride basis. This fleet subsidiary will be twinned with a wholly-owned customer transport business that will take care of all travel needs, using the fleet vehicles to conduct all travel except long-distance journeys (which might involve air travel or high speed rail). Whilst the mobility business is immature, companies might find themselves trying to offer a complete service to fully stimulate demand but if they continue operating this way as the market nears maturity then they will find themselves operating far more broadly than other industries. It would be like the same company making an aeroplane, having an airline and running a travel agent. Corporations that can do this will be the best companies in the world; they will have mastered the challenge of running a conglomerate. The list of possibilities is endless: where will they go next: ice cream or diamonds? The business reality will be far different, and for good reason: Google knows artificial intelligence but not much about complex mechanical machinery and high volume production; GM knows about designing and building cars but doesn’t have much experience of e-commerce and customer-facing services; Uber knows about linking customers with taxis and taking payment but it doesn’t know the nitty-gritty of owning, servicing and cleaning thousands of vehicles per day. Companies that try to do it all will lose out to well-balanced partnerships.

- Operators will not get to become long term monopolies. If they do manage then they will have succeeded where mobile phone operators, media companies, airlines and hosts of others have failed. Any monopolies won’t last long. The assumption of monopoly potential is based dominance of Google and Facebook in their respective markets but this ignores that those segments operate in conditions which make it hard for regulators to judge what is in the consumer’s best interest: the service is free at point of use. If someone has this model for operating robo-taxis, we are yet to see it. If, as we suspect, they intend to charge money and make a profit then expect competition authorities to come after monopolistic activities. They have plenty of tools at their disposal, ranging from crude break-ups to licencing granted via auction in traches where any single bidder can only win a fraction of the total amount.

- Long-distance commuting while sleeping in driverless cars will be niche. Some dream of a non-stop world where we virtually live in vehicles always on the move. Multi-millionaires provide a clear counterpoint though: they could choose to do this now, a customised van with driver wouldn’t set them back very much ($350,000 for something with an interior befitting a corporate jet) and yet few of them do so. For centuries, humans have commuted for about an hour a day. A trend that has seen off the train, coach and car is likely to have the measure of robo-taxis too.

- Widespread use of flying cars? Come off it. There are plenty of obstacles that driverless cars must overcome (not least of which is price) and yet technological and logistical issues surrounding quadcopters-for-all can be resolved in a short time frame? Wake us up once air traffic control has been automated and can handle exponential increases in traffic.

The End Result

It will be exciting, lots of money will be lost, lots of money might be made. People who got lucky will, after the event, say that they had it figured out all along. Whenever you see an apparently definitive forecast, tell yourself that it’s a best-guess and ask yourself how it might be affected by the variables listed here. If you want to tear our points to shreds then please read the comprehensive report first. Reading the detail will help you prepare an even more compelling counter-argument!

Hopefully you enjoyed this post! If you want a hard copy, you can find a PDF version here.

Latest Automotive Industry News Review — 15th May to 21st May 2017

We’ve just released our latest weekly review of automotive industry news and trends. You can find it here as a downloadable document.

Our favourite story this week? Can we say our own research into mobility? We think that this is the most comprehensive first principles analysis openly published — whether you share our conclusions it should still be useful in forming or supporting your own. If we had to choose a story from the news itself… the Japanese hydrogen network and fuel cell consortium looks interesting… could this do for fuel cells what Tesla’s supercharging network did for BEVs? Sorry for not choosing Lyft/Waymo…

Ford’s succession rumours are breaking today so missed our weekly cut-off…

For all this and more, take a look at the pdf, or just read on…

Find our archive here.

SIGN UP FOR THE WEEKLY UPDATED TO BE EMAILED TO YOU HERE

Our latest research

We’ve just published a detailed review of the fundamentals behind the driverless on-demand mobility business case. We start with the facts of how people travel today and assess the key factors behind market growth rate and mass acceptance.

- Read the detailed report here (22,000 words)

- Read a summary presentation here (34 slides)

- Read the executive summary blog post here (1,500 words)

Company-by-company rundown

BMW

- Announced that Delphi has joined the self-driving alliance BMW created with Intel and Mobileye. Delphi will act as the system integrator and seemed a logical choice given the existing cooperation it has with Mobileye. (..)

- UK media reported on CEO Harald Kruger’s comments that the Mini plant in Oxford could be negatively affected by Brexit, saying the BMW was planning “in terms of scenarios” and “was flexible” on the source of Minis. (..)

- Settled a US class action case relating to failure of airbags supplied by Takata. The overall bill was $553 million of which BMW’s share was $131 million. (..)

- Warned investors that R&D spending will increase to about 6% of sales in 2017 and 2018 due to extra investment in CO2 reduction technologies and electric vehicles. (..)

Daimler

- Daimler and BYD will reportedly increase capital in their 50/50 electric car making JV, Shenzhen Denza New Energy by 1 billion yuan. (..)

- Will reportedly cooperate with Tesla Energy’s rival Vivint to offer a combined solar-roof and battery storage product in Germany. (..)

FCA

- Saw reports that the US Justice Department will file a suit covering 104,000 vehicles with excess emissions from their diesel engines. The Justice Department if following up an accusation made in January by the EPA. (..). FCA believes that it has a fix available and is seeking regulatory approval to apply it. (More…)

- Reported official April sales figures for Europe. Group sales of 89,300 vehicles were 0.5% lower year-over-year, which FCA attributed to fewer selling says. FCA said that share had risen 50 points to 7.3% (7.2% on YTD basis). The growth was primarily from the Fiat band. (..)

- The European Commission announced that it would begin infringement proceedings against Italy for not properly following EU rules for vehicle type approval. The move is related to approval of FCA vehicles. (..)

- Issued a press release touting the use of Samsung supplied technology to improve productivity at its Alfa Romeo plant in Cassino, Italy. (..)

Ford

- Has launched a buy out programme targeted at making 1,400 job cuts in North America and Asia. The figure is 10% of a targeted subset of the workforce in these locations. Media had initially reported figures of up to 20,000 job cuts, consistent with a 10% reduction in the entire global workforce. (..)

- Head of product development Raj Nair said that Ford was using recent acquisition Chariot to experiment with fleet management and could develop it into a tool for autonomous fleet management. (..)

- Announced Europe sales results for April. Overall sales of 100,800 vehicles were down 11% year-over-year. Passenger car sales fell 13% YoY, while commercial vehicles fell 5%. Ford trumpeted SUV sales growth. (..)

- Said that it will invest $350 million into its transmission plant in Livonia, USA. The investment will create 800 jobs and be for a new front wheel drive transmission. (..)

Geely (includes Volvo)

- Volvo’s CEO said that the company will likely not develop any “new generation” diesel engines. He said that the company would make upgrades to the existing architecture, launched in 2013, that would probably allow them to remain in production until about 2023. (..)

- Volvo cars said that it would begin production in India with the aim of doubling its market share. The production will use Volvo Trucks’s infrastructure, but no exact details of how this will work were supplied. (..)

- Media speculated that the sale process for Proton is reaching a close. Geely is one of the two final bidders. (..)

General Motors (includes Opel / Vauxhall)

- Made some major changes to its International Operators division, which it expects will realise annual savings of around $100 million. GM will stop selling Chevrolet vehicles in India, although car production there will continue — focused on exports (to Mexico, Central and South America). GM will sell its GM South Africa light commercial vehicle manufacturing operation to Isuzu and stop producing and selling Chevrolet vehicles there (this follows an earlier sale of GM East Africa assets to Isuzu). Special Items of about $500 million will be reported as a consequence. (..)

- Media reported on the small supply of Ampera-e vehicles in Europe. Opel reportedly has only trained 40 electric car specialists in Germany (there are around 2,400 dealers) and the car will only be available via leasing. Outright purchase will not be an option. (..)

- Lyft, in which GM holds a significant stake, confirmed it had agreed to work together on deployment of autonomous vehicles with Alphabet’s (Google) Waymo. Lyft said that Waymo holds “today’s best self-driving technology”. It was unclear what effect this would have on GM’s plan for Lyft to deploy vehicles using technology from GM’s Cruise subsidiary. (..)

- Said that it was making an industry leading commitment to use tyres sourced from sustainable rubber but did not give a commitment for when it would reach that goal. (..)

- Bloomberg profiled the strategy and actions of CEO Mary Barra and President Dan Ammann to withdraw from unprofitable markets and products. (..)

Honda

- Will be part of an 11-company consortium that aims to accelerate roll-out of hydrogen stations in Japan, targeting 160 stations and 40,000 fuel cell vehicles by 2020. (More…)

Hyundai / Kia

- Was forced to deny rumours that it will introduce a holding company structure. (..)

- Will be investigated by the US National Highway Traffic Safety Administration over the way that it handled a recall for vehicles that were at risk of engine fires. (..)

Mazda

- Settled a US class action case relating to failure of airbags supplied by Takata. The overall bill was $553 million of which Mazda’s share was $76 million. (..)

Nissan

- Said that a credit card it had launched in partnership with Synchrony Financial could form the basis of a payments platform for mobility services. (..)

- Will be part of an 11-company consortium that aims to accelerate roll-out of hydrogen stations in Japan, targeting 160 stations and 40,000 fuel cell vehicles by 2020. (More…)

- A recent North America supplier relations survey saw Nissan drop to the bottom of the comparative ranking table of how Tier 1 suppliers perceive OEMs. (..)

PSA (excludes Opel/Vauxhall)

- PSA and Aisin reportedly in talks to extend their existing cooperation on gearboxes. The proposals reportedly include PSA licensing Aisin designs for in-house production. (..)

- Media speculated that the sale process for Proton is reaching a close. PSA is one of the two final bidders. (..)

- Signed a joint venture agreement with SC Uzavtosanoat to produce light commercial vehicles is Uzbekistan. The licence will be for production of up to 16,000 vehicles per year from 2019 (including for export). (..)

- Faurecia announced an exclusive agreement to develop carbon fibre composite fuel cell tanks based on technology from aerospace company Stelia Aerospace Composites. (..)

- Faurecia said that it was joining a German cluster researching carbon composites with the aim of introducing them into production vehicles in the early 2020s. (..)

- PSA’s Vesoul Facility had a fire that destroyed a building on the site. No downtime will result from the blaze. (..)

- Management and unions at the Rennes factory agreed to add workdays due to the success of 5008. (..)

Renault

- According to French media, the incoming French government has complained to Renault about the way that the company’s statements portrayed the impact of the State’s shareholding. (..)

Tesla

- CEO Elon Musk criticised those holding back the advance of autonomous technology saying that they were “killing people”. (..)

- Announced that all owners who had purchased vehicles since 1st January would be given free supercharging for life (as was the previous arrangement) rather than a capped yearly amount. As of now, new vehicles sold will have the previously announced capped level of 400 kWh per year. Lifetime charging will still be available for buyers in possession of a special referral code. (..)

Toyota

- Settled a US class action case relating to failure of airbags supplied by Takata. The overall bill was $553 million of which Toyota’s share was $279 million. (..)

- Announced the launch of a restroom information service at around 19,000 sites in Japan. The aim seems to be to show off the capabilities of Toyota’s telematics service. (..)

- Will be part of an 11-company consortium that aims to accelerate roll-out of hydrogen stations in Japan, targeting 160 stations and 40,000 fuel cell vehicles by 2020. (More…)

VW Group

- Announced the extension of Audi CEO Rupert Stadler’s contract for a further five years. Audi have also made integrity part of the CFO’s responsibilities. (..)

- Audi announced that as part of a working group with city governments, the German standards institute and other companies it had developed a standardised set of terms for the city of the future called DIN 91340. (..)

- Audi announced that it had agreed a new contract with its dealer body in China. A dispute had arisen with FAW-affiliated dealers about how vehicles from Audi’s new partnership with SAIC would be sold. The new agreement states that all Audi models (regardless of source) will be sold by the FAW dealers and remains unclear on how the relationship with SAIC will develop. (..)

- The UK government refused a freedom of information request relating to talks it had held with Bentley over the way Brexit could impact the company’s investments in the UK. The government said that this was because it could weaken the UK’s negotiating position. (..)

- Following on from media speculation last week, German authorities confirmed that they would investigate CEO Mueller and Chairman Potsch (relating to market manipulation at Porsche SE on the basis of not telling shareholders quickly enough about the extent of VW’s diesel scandal). (..)

- VW’s joint venture in China with FAW will recall 577,590 vehicles because of a headlight fuse defect. (..)

- CEO Mueller said that he was already in talks with the Board about his successor (his contract expires in 2020) and that the successful candidate was likely to come from within the company (More…)

Other

- Aston Martin is reportedly considering an IPO as early as next year. The company declined to comment, referring enquiries about its future structure to the current owners. (..)

- Isuzu agreed to purchase GM’s operations in South Africa. As a part of the deal, Isuzu will buy out GM’s 30% stake in its South African subsidiary. (..)

- Media speculated that the sale process for Proton is reaching a close, with Board meetings taking place to consider rival bids by Geely and PSA. (..)

- Subaru settled a US class action case relating to failure of airbags supplied by Takata. The overall bill was $553 million of which Subaru’s share was $68 million. (..)

- Suzuki announced a series of leadership changes, including new director and executive vice president appointments. (..)

And now for the other news…

Economic / Political News

- European registrations for April were announced, passenger car sales of 1.191 million fell 6.6% year-over-year. Trade body ACEA said that the main reason for the drop was fewer selling days due to Easter. Of the Big 5 markets, only Spain grew. EU member states since 2004 (EU12) grew by 8.2% YoY. The market is up 4.7% YoY YTD. (..)

- The European Commission announced that it would begin infringement proceedings against Italy for not properly following EU rules for vehicle type approval. The move is related to approval of FCA vehicles. (..)

- The Trump Administration has notified US Congress that it is seeking to renegotiate NAFTA. (..)

- The UK Conservative party included in its manifesto a policy for “almost every car and van” on UK roads to be zero emission by 2050. They have promised to invest £600 million by 2020 to help achieve it — leading to speculation that a scrappage scheme is in the offing. (..)

Suppliers

- There was an explosion at a Schaeffler factory in Eltmann, Germany. 23 people were injured with 7 requiring hospital treatment. (..)

- ZF said that it will create a joint venture called e.Go Moove with start-up Go Mobile to produce a 15 seat autonomous electric minibus, for which it will supply the electric drive and some autonomous components. (More…)

- ZF said that it would purchase the automotive division of Romanian engineering services company BeeSpeed. The acquisition is related to critical expertise BeeSpeed employees have provided to ZF’s braking systems business over the past ten years. (..)

- Faurecia announced an exclusive agreement to develop carbon fibre composite fuel cell tanks based on technology from aerospace company Stelia Aerospace Composites. (..)

- Faurecia said that it was joining a German cluster researching carbon composites with the aim of introducing them into production vehicles in the early 2020s. (..)

- Saw media speculation that a settlement by four OEMs of some US claims relating to Takata’s airbags (others remain outstanding) might help the company find a buyer. (..)

- Raw material supplier Glencore’s CEO Ivan Glasenberg said that the “electric revolution” was underway and likely to be felt faster than expected. (..)

- 3M will sell is tolls and automated numberplate recognition business to Californian company Neology. (..)

- Dana said that it will build a new $13 million, 7,500 sqm factory in Chongqing, China for production of AWD transmission components. (..)

- Denso said that it will build an additional plant on its Fukushima, Japan site for the production of powertrain components. The investment will be about $135 million and production will begin in late 2018. 600 jobs will ultimately be created. (..)

- Cimos, a Slovenian car parts maker, has been sold by the government to TCH. (..)

- The Finnish financial regulator referred Nokian Tyres to the police over reported insider trading and irregularities in the way it supplied tyres to journalists for consumer comparison tests. (..)

- UNO Minda and Microsoft will collaborate on connected car technologies aimed at the Indian market. (..)

Dealers

- UK dealer group Peoples announced that it had sold its Ford dealership in Accrington (NW England) to Oldham Motor Company. (..)

Ride-Hailing & Car Sharing

- Uber announced Uber Freight, a business to match up drivers and loads. (..)

- Bosch has announced a scheme that will offer self-service short term rental of 600 scooters in Paris. This is the first expansion after its initial scheme in Berlin. (..)

Driverless / Autonomy

- Waymo and Lyft confirmed that they have agreed to work together on deployment of autonomous vehicles. Waymo cited Lyft’s commitment to “improving the way cities move” as part of the logic for the tie-up, whilst Lyft said that Waymo holds “today’s best self-driving technology”. (..)

- Ford’s head of product development Raj Nair said that Ford was using recent acquisition Chariot to experiment with fleet management and could develop it into a tool for autonomous fleet management. (..)

- ZF said that it will create a joint venture called e.Go Moove with start-up Go Mobile to produce a 15 seat autonomous electric minibus, for which it will supply the electric drive and some autonomous components. (More…)

- Tesla CEO Elon Musk criticised those holding back the advance of autonomous technology saying that they were “killing people”. (..)

- Bloomberg published an updated graphic of tie-ups in the mobility space. (..)

- Car sharing company Getaround said that it was developing technologies that would allow it to provide on-demand maintenance services in future. (..)

Electrification

- The German government has accepted that it will not meet its goal of one million electric vehicles on the road by 2020 according to comments by Chancellor Angel Merkel. (..)

- Raw material supplier Glencore’s CEO Ivan Glasenberg said that the “electric revolution” was underway and likely to be felt faster than expected. (..)

- Speculation among trade press in the UK that dealers may be more prepared to stock used electric vehicles, following a rise in auction prices. (..)

- Israeli firm StoreDot claims that it has developed new battery chemistry that allows 300 miles of range to be charged within 5 minutes. (..)

- Qualcomm said that it had demonstrated a method for wireless charging at highway speeds via a specially equipped road surface and using two Renault vehicles. The claimed charging rate of 20 kW is the same as a high-powered home charging unit. (..)

Other

Chauffeurs For All — Mobility From First Principles

On-demand mobility is a new and exciting area, promising a world where travel is better, cheaper, faster and safer. Although there are thousands of employees and many billions of dollars being put to work by start-ups and traditional car companies alike, business forecasts appear in the main to be subjective and based on individual intuition. This would make sense in unchartered territory but mass-transportation exists as a business today. It has existed for many decades.

On-demand mobility may change business models and the way travel is experienced, but it is not starting from scratch. People travel trillions of miles each year. There is plentiful data about how they do so.

Our key findings are as follows:

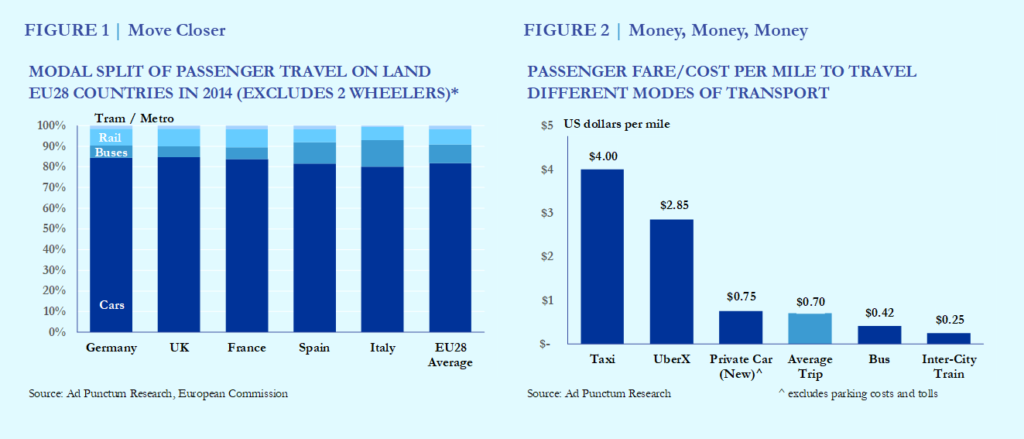

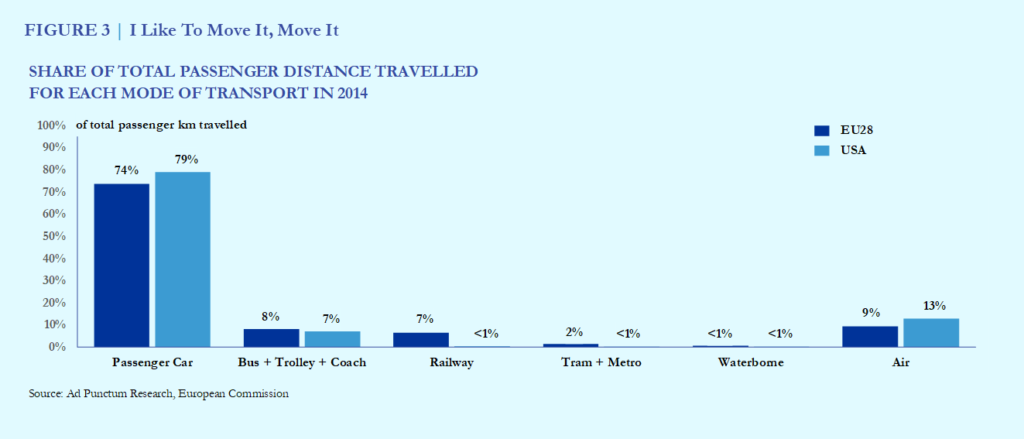

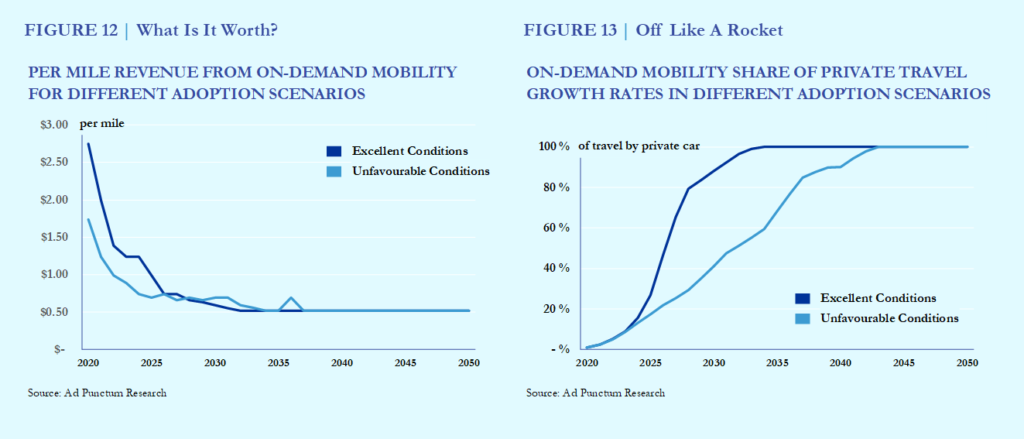

- Current average spending on land-based travel is about $0.70 per mile — the figure is slightly higher in the US and a little lower in the EU28. This is the share of spending that on-demand mobility companies are competing for. Although some modes of transport (e.g. public buses and rail) are substantially cheaper than cars, this does not meaningfully skew the average because of the dominance of the passenger car for land travel

- Any big switch to on-demand travel isn’t coming from rail, bus and air — it comes from car ownership. The clear majority of passenger miles travelled are already by privately-owned car. Whilst there is potential for transfer from other sources (e.g. buses) and creating incremental travel, our analysis is that this amounts to between 15% – 25% of the market. Most on-demand revenue comes from people subscribing to a service that covers all their travel needs rather than buying a car.

- The potential revenue of a wholesale switch to on-demand is huge — $6 trillion per year. Already the population of the EU, USA and China collectively travel more than 8 trillion miles annually, a figure that will increase through economic growth. Changing from private car ownership to on-demand unlocks that revenue without even changing travel behaviour.

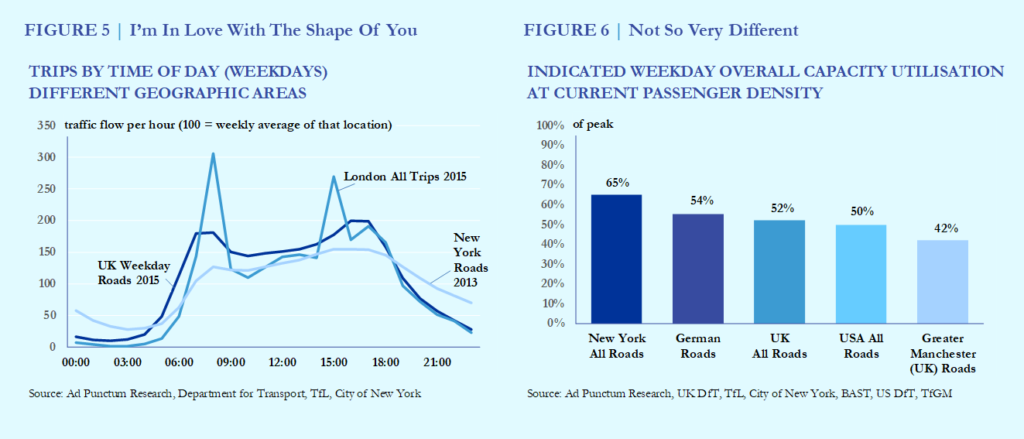

- Establishing a viable on-demand model faces a big problem — capacity utilisation. The pattern of “rush hours” holds across different regions and countries. Utilisation assumptions above 50% are optimistic. Without sufficient capacity, people won’t give up their cars. If they don’t do that, on-demand struggles for market share.

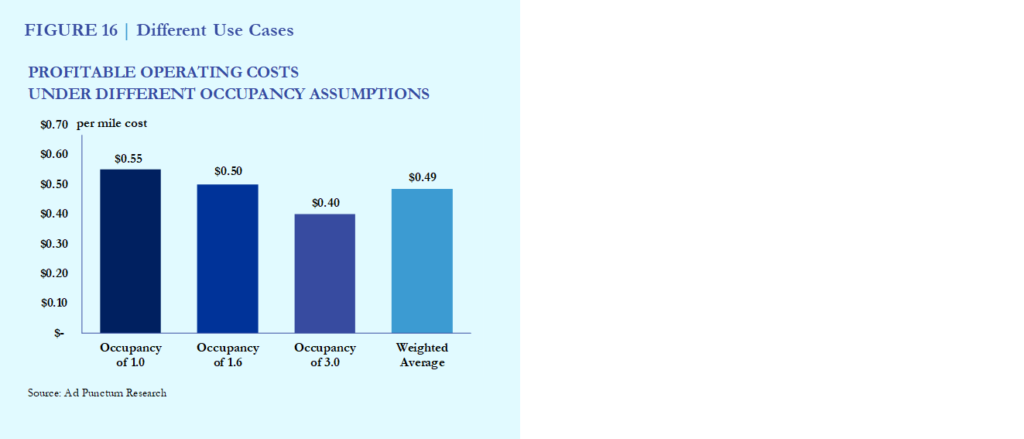

- Driverless on-demand services can achieve prices of $0.60 per mile and below even without sharing and will dramatically reduce car production — by between 60% – 75%. The privately-owned car is so inefficient in terms of utilisation that even lower-end assumptions for system efficiency drastically reduce the number of new cars needed.

- Autonomous vehicles will be capable of most journeys sooner than many people think — by the early 2020s. The classic driverless test is a narrow urban road filled with perils but this is a rarity, not a day-to-day reality, for most journeys. Around 70% of travel in the USA and UK is on major arterial roads and highways — the technology is nearly capable of this now. Driverless cars don’t need to be capable on 100% of routes to capture share. The network will grow road-by-road, just like cable TV.

- Widespread autonomy will be with us by 2030 — accounting for at least 40% of mileage. The rate of switchover depends on three things: price, technology and regulation. The rate at which taxis win share as price drops has been studied for many decades. Taxis win share slowly and it is only the rich who can afford to pay extra. If you look at it from Uber’s point of view, growth seems meteoric but this is from a very low percentage of travel in taxis (about 1% of trips) to a larger but still very low percentage of travel via ride-hailing. Reaching cost parity with car ownership creates a dramatic consumer response. Favourable regulation and technology progress could double the rate of adoption (to over 80% in 2030). This level of growth may not require a colossal amount of upfront funding — cash flow is hugely positive since revenue is still related to taxi services with human drivers (albeit with discounts) but costs are far lower.

- Regulators have a substantial role in the rate of adoption. It isn’t sufficient for driverless cars to be good enough, they must also be legal. Regulators aren’t in universal agreement on what is good and bad about “dumb” cars today; myriad different laws, technical standards and tax rates attest to that. Expect autonomous vehicles to create even more regulatory misalignment. The upshot will be that those who are favourable to driverless on-demand mobility, and control access to significant markets, may shape the fundamental industry model and technical standards. It may not be the “best” technical delivery of an autonomous vehicle that becomes widespread, it could be the one that was most convincing to those governing the streets of California, London and Singapore. A very likely manifestation is that successful operating models will be ones that regulators see as win-win situations. For instance, a fleet that is entirely battery-electric. They will also shape operating details such as how fast a vehicle can drive in certain circumstances (manufacturers will struggle to justify that their vehicles are fool proof in freezing conditions) and whether it is the passengers or a remote control centre that takes over the vehicle if the automatic systems fail.

- Autonomy will struggle to take public transport’s 15% share whilst fares are above $0.40 per mile. Once this level is reached, the 15% or so of public transport customers could switch. Public transport loses money but it keeps fares low at the point of use and more than half of its customers are price sensitive. Without an innovation that transfers the existing public transport subsidy to on-demand customers on a means-tested basis, they will wait for a lower fare level before switching.

- The increase in travel from people less restricted than today is likely between 5% – 10%. Increased freedom for those with restricted mobility will be welcome but will not substantially change the fleet mileage because they are a relative minority in the population and they already travel today (albeit less frequently than average).

- Travel at $0.40 per mile is within reach. It might not even require special vehicles. Although research work continues into on-demand vehicles with capacities of 10 people and above, this may remain in the domain of pure academia. A system carrying an average of three people at a time could still be profitable and use the same vehicles for solitary customers paying a higher price.

- A price structure similar to UberX versus UberPool is likely to persist. Creating a single fare level ignores some of the fundamental dynamics of human choice. In general, people don’t like to share if they can afford it. Therefore, it is more likely that richer people will choose to pay more to ride alone or with close family and friends.

- Governments are going to face some tough decisions on public transport eventually. If on-demand services can match the $0.40 per mile price point as we forecast then customers will adopt on-demand due to its lower overall travel time, door-to-door service and additional convenience (“remember the olden days when we actually used to stand in the bus?”). This will be a mixed blessing for governments. On the one hand, they can remove the substantial subsidies currently paid to public transport operators. On the other, vested interests (those losing their jobs — from station masters to route-planning bureaucrats) and political idealists (who hate the idea of the private sector running transport) will lobby not to abandon public provision of services. They will have more success in some countries and cities than others.

What does this mean? The adoption of on-demand mobility is going to depend primarily on cost as long as regulators don’t get in the way. Although adoption scenarios vary in timing by a decade due to variation in regulatory and consumer preference, there is a route to $0.40 per mile across regions. Mass adoption will considerably reduce vehicle sales, so for carmakers the exact timing is academic — they should begin planning for massive capacity reduction. An industrial purchasing base may support fewer brands too (aircraft, oil service suppliers, mobile phone infrastructure builders point in this direction). Suppliers will worry too. For everyone else? Chauffeurs for all (in time)! Catch up on sleep, start a food blog for pets or maybe just take in the scenery.

Latest Automotive Industry News Review — 8th May to 14th May 2017

We’ve just released our latest weekly review of automotive industry news and trends. You can find it here as a downloadable document.

Our favourite story this week? It’s a bit of a nerdy one but the comments by Mark Reuss saying that GM expect to meet their cost target of $100/kWh for battery cells earlier than expected feels significant. Electrification doves will shrug their shoulders and say “I told you so” but when one of the biggest car companies says that electrification cost is coming down faster than they expected, others will take note.

For all this and more, take a look at the pdf, or just read on…

Find our archive here.

SIGN UP FOR THE WEEKLY UPDATED TO BE EMAILED TO YOU HERE

Company-by-company rundown

BMW

- Said that it had record sales in April of 192,494, an increase of 7.4% year-over-year. Sales of electrified vehicles rose 82.7% YoY to over 25,000 units. The Chinese market was the main driver of growth. (..)

- Announced an agreement with the City of Hamburg to form a strategic partnership concerning urban mobility. As a part of this, the Hamburg fleet of DriveNow vehicles will expand to 550 cars by 2019 (400 pure electric, 150 PHEV) and the city will provide 1,150 charging points. (..)

- Media reported that BMW was planning to raise production capacity to 3 million units by 2020. (..)

- Said that it has not made any changes to its plans for production in Mexico. (..)

- CEO Harald Krüger called sustainability “a marathon” in his introductory comments to the AGM. He also said that sustainable mobility “thrives wherever there is a combination of three factors: customer, legislation and industrialisation”. He also promised small-scale fuel cell vehicle production in 2021. (..)

Daimler

- Mercedes will no longer pursue certification for their diesel engines in the USA, based on the very small market share for the technology and the increased difficulty in obtaining regulatory approvals. This affects 2017 and future model years. (..)

- Launched a platform for e-identity and data services in partnership with HERE, Allianz (an insurance company), Axel Springer (a media company), Deutsche Bank and CORE (a think tank). The service aims to provide a “master key” that will allow people to register across a number of different providers with the same identity. (..)

- Said that its Car2Go car sharing scheme had seen a significant increase in “cross-border” rentals in Q1 2017 with 33,000 journeys taken by customers visiting from other European countries using the local Car2Go service. (..)

- The Mercedes brand will open a global digital delivery hub in Lisbon, Portugal. The brand says that Lisbon is “the place to be” for the digital world. (..)

FCA

- Announced a recall of around 1.25 million trucks in the USA. The recall is to fix software that may cause safety equipment to fail to deploy in the event of an accident. (..)

- Will recall around 1,800 Jeep vehicles in Russia. This is a different recall to the one announced at the end of March. (..)

Ford

- Saw increased pressure on CEO Mark Fields due to the company’s poor stock price performance since he took over. Media reports speculated on the motives for a reported scheduled extension of a board meeting in order for board members to question Fields on the company’s strategy but it was unclear if this was something other than normal practice. (..)

- Ford of Europe, Middle East and Africa CEO Jim Farley called for ideas to reduce the number of cars in cities saying “we must work on how to take cars out of the system when there is an alternative, more sustainable solution”. (..)

- Ford of Europe, Middle East and Africa CEO Jim Farley said that UK trade deals with Turkey and South Africa were “equally important” to a post-Brexit trading agreement between the UK and EU. He also said that a transition period would be “really critical for the future of our investments in the UK”. (..)

Geely (includes Volvo)

- Volvo’s CEO said that the company was updating its business model due to the changing business environment and that other companies needed to do likewise. In particular he cited the consumer desire for “safer, more sustainable and convenient cars” and that Volvo recognised the limitations of the internal combustion engine. (..)

- Said that it will build a new R&D centre in Hangzhou, China at a cost of around €830 million. Geely also said that it is aiming for Level 3 automation of vehicles by 2019. (..)

- Purchased a 30% stake in Danish bank Saxo bank, primarily from the co-founder. Geely hopes to find synergies that allow development of financial services. (..)

- Volvo Cars received a rating upgrade from Standard & Poors. The rating moved rom BB with a positive outlook to BB+ with a stable outlook. (..)

General Motors (includes Opel / Vauxhall)

- Cadillac’s President gave an interview where he said that the brand was growing in line with plan and that moving the headquarters to New York had been a success. (..)

- Announced that layoffs at its Delta township plant would be lower than previously speculated (about 600 jobs will be lost rather than the 1,100 figure from March). (..)

- Said that it was making better than expected progress on reducing battery cost. GM said that against a previous target of $100 per kWh for a battery cell by 2022, GM’s head of product development Mark Reuss said “we’ll be there before then, I know we will”. Reuss also said that GM is trying to reduce the Bolt’s weight in order to have the same range with fewer battery cells. (..)

Hyundai / Kia

- Lost an appeal against a (March 2017) recall decision by the South Korean transport ministry. The companies will now have to recall around 240,000 between them. (..)

- Hyundai subsidiary Hyundai Wia will end its turbocharger joint venture with IHI and will take over the partnership’s plant in Seosan, South Korea. (..)

Nissan (including Mitsubishi)

- Mitsubishi Motors announced results for financial year 2016. Global sales of 926,000 units was a 12% fall year-over-year. Full year revenues of 1.9 trillion yen were down 16% YoY. Full year operating profit was 5.1 billion yen with a net loss of 198.5 billion yen. Despite the losses, the performance in the last six months was seen as positive progress after the fuel economy crisis that lead to Mitsubishi’s rescue by Nissan. (..)

- The CEO of Mitsubishi Motors said that he will stay in post for the 2017 financial year and has not yet decided on his future beyond that. (..)

- Renault CEO Carlos Ghosn said that it was “good news” that Emmanuel Macron had been elected president of France. Macron was the architect of the move by the French state to purchase a sufficient stake in Renault to force the Florange law terms for double voting rights for long term shareholders to pass. (..)

- Nissan announced 2016 financial year results. Global sales were 5.63 million units. Revenue of 11.72 trillion yen was down 3.9% year-over-year. Operating profit of 724 million yen was down 6.4% YoY. Nissan said that the profit and revenue falls were more than explained by exchange and that adjusting for this the YoY performance would have been revenue up 6.4% and profit up 29.1%. The company also gave an outlook for the current financial year. It expects sales to increase to 5.83 million units but operating profits to fall to 685 billion yen. The profit drop was mainly explained as being due to higher raw material costs and exchange volatility. (..)

- Confirmed that the Nissan Sunderland plant had experienced problems due to the “WannaCry” cyber attack but that there was “no major impact”. (..)

PSA (excludes Opel/Vauxhall)

- Announced further increases in personnel at Sochaux to deal with demand for the 3008 SUV as well as expected orders for Opel / Vauxhall’s Grandland X. The plant will recruit a further 1,000 people who will staff a 28 hour weekend shift running from Friday to Sunday. Product rate of 3008 will increase from 700 to 1,000 per day as a result. Union representatives have expressed concern that there will be too many temporary positions at the plant. (..)

- Had a tax incentive of around €19 million approved by the Slovak government to support PSA’s investment of about €165 million in its factory there. (..)

- Received shareholder approval for the purchase of Opel and Vauxhall. (..)

Renault

- Shut down some sites in response to the global “WannaCry” cyber attack. Although Renault did not state which sites were affected, off-the-record sources mentioned Sandouville, Batilly, Dacia’s plant in Mioveni and Novo Mesto amongst others. (..)

- Renault CEO Carlos Ghosn said that it was “good news” that Emmanuel Macron had been elected president of France. Macron was the architect of the move by the French state to purchase a sufficient stake in Renault to force the Florange law terms for double voting rights for long term shareholders to pass. (..)

- The Renault Duster scored zero stars in recent global NCAP crash test. (..)

- Renault’s senior vice president for electric vehicles said that mobility will evolve from car ownership to purchasing a service but that adoption rates would vary by country and the “same amount of cars” would be needed. (..)

Suzuki

- Announced results for 2016 financial year. Consolidated net sales of 2.169 trillion yen were down 0.3% year-over-year. Operating income of 266.7 billion yen was up 36.5% YoY. Outlook for the current year is an increase in net sales of 7.3% YoY but a reduction in operating income of 10% YoY due to “investments for growth”. (..)

- Suzuki will invest a further 100 billion yen in its Indian operation to increase production by installing a third line in its Gujarat plant. This is on top of investments for a second line which is not scheduled for launch until 2019. (..)

Tata (includes JLR)

- Said that global wholesales fell in April. Total sales of 73,691 units were 9% down year-over-year. JLR sales fell slightly to 41,923 units, down about 2% YoY. The main reason for the group’s drop was commercial vehicles and the Tata Daewoo range where sales fell 36% YoY. (..)

Tesla

- Started taking orders for its solar roof tiles. The proffered warranty period is infinity or the lifetime of the house. (..)

- Used its blog to publicise its efforts to improve health and safety in its Freemont plant as part of an effort to stop the UAW campaign for worker representation from gaining momentum. (..)

- Announced it will offer a service to improve local grids through putting Powerwall and Powerpack batteries into people’s homes and then connecting them. Both the homeowners and the company that owns the batteries will be able to use them for demand smoothing. Tesla already has two pilot projects (50 – 100 units) underway and announced a 2,000 unit project with Green Mountain Power. (..)

Toyota