Auto Industry Briefing — week ending 17th May 2020

Remote working converts; fighting water with water; and a dent in the limited edition bubble? Please enjoy our auto industry and mobility briefing for 11th May to 17th May 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Sofa Song — PSA say that coronavirus has proved that teleworking is the way forward. In the near future, staff will only spend one and a half days in the office, and all the time they spend there will be a constant whirlwind of high-energy creative meetings. By implementing these measures, PSA hopes to save on office space, and money. Clearly, PSA executives believe they have cracked communication problems often associated with remote working on this scale. How should we interpret the silence of their competitors?

- November Rain — VW’s ItalDesign unit is working on a safety system to reduce aquaplaning. It sounds hard to believe, but the idea is to clear the water by spraying a jet of… water… at the ground. It remains to be seen how reliable the feature could be but it demonstrates the kind of innovation that could be feasible for frequently serviced autonomous vehicles but which would never work in a world of privately owned cars where owners often run out of fuel, not to mention ancillary water tanks. Are we underestimating the potential safety improvements?

- Pop Goes The Weasel — Aston Martin admitted that there had been cancellations for some of the highly-priced “special” cars the firm relies on for so much of its (ahem) profits. In the same breath, company representatives reassured investors by saying waitlisted customers had immediately taken the newly vacated slots, but it indicates a weakness for these must-have products. Is this the normal ebb and flow of product ordering and nobody normally asks about it, or is there a softening of demand?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- BMW’s CEO is expecting several large markets to be “very slow” to recover and believes that the Chinese market might not be a good guide to consumer confidence elsewhere. (BMW)

- Says that plans to commission a new plant in Debrecen, Hungary, are unaffected by coronavirus. (BBJ)

- PSA and FCA jointly decided not to issue any ordinary dividends in 2020. (PSA)

- Working on a credit facility backed by the Italian government that would be open to FCA and Italian automotive suppliers, worth up to €6.3 billion. (FCA)

- The breakdown of a deal by major FCA shareholder Exor to sell an insurance unit, after the prospective buyer tried to negotiate a price reduction, was seen by some as a warning to PSA not to re-open the merger valuation. (Reuters)

- Confirmed that over the air updates for the forthcoming all-electric Mustang Mach-E will be capable of upgrading “nearly all” of the software on the vehicle, and extend far beyond the infotainment-only upgrade functionality that some brands are touting. (Ford)

Geely (includes Volvo) (history)

- Lotus chose UK utility Centrica to provide electricity for owners. Unusually, the partners say that their aim is to establish global infrastructure — such deals normally only cover a country or region. (Centrica)

- Believes that lessons learned from the recent UAW strike will help it ramp up North American factories to full capacity within four weeks of returning, demand permitting. (Detroit Free Press)

- Shut down the Ariv electric bicycle project. (The Verge)

- Laid off about 8% of staff at the Cruise self-driving unit, despite indicating that spending would be ring-fenced. GM’s CEO said the cuts were “prudent”, focused on non-technical areas and called the company’s commitment to the business “unwavering”. (Reuters)

- Reported financial results for the fiscal year ended March 2020. Sales of 4.8 million automobiles fell (10)% on a year-over-year basis. Automotive revenue of 10 trillion JPY (about $93 billion) fell (8)% net of currency effects (group revenue was 14.9 trillion JPY). Automotive operating profit of 153 billion JPY (about $1.4 billion) fell (27)% (group profit was 634 billion JPY). (Honda)

Mazda

- Reported full fiscal year (April 2019 to March 2020) financial results. Net sales of 3.4 trillion JPY (about $32 billion) fell (3.8)% on a year-over-year basis. Operating income dropped (47)% to 43.6 billion JPY (about $405 million). Mazda’s cash balance dropped about $(1.2) billion during the year, despite the relative stability and the company refused to provide guidance for the current year. (Mazda)

- Significance: Toyota already holds significant stakes in Mazda and Subaru with a full takeover a likely response to severe financial distress by either brand.

Nissan and Mitsubishi (history)

- Ahead of Nissan’s announcement of its new strategy (set for 28th May), details reportedly leaked: the Barcelona plant is set for closure; Nissan will make Renault products (said to be Captur and Kadjar — sister vehicles of the Juke and Qashqai) at the Sunderland, UK, factory. (Nikkei) Datsun will be chopped entirely, rather than being scaled down, according to some as part of moves to save $2.8 billion annually. (Bloomberg) Nissan didn’t deny any specific points but said the plan was still in progress. (Nissan)

- Looking to raise up to $4.7 billion in bonds to fund restructuring. (Nikkei)

- PSA and FCA jointly decided not to issue any ordinary dividends in 2020. (PSA)

- Implementing widespread teleworking in response to coronavirus has convinced PSA that this is the way forward. Staff can expect to spend around 1 – 1.5 days per week in the office, with the remainder working from home. As a by-product, PSA expects to reduce floorspace thereby cutting carbon emissions (oh and cost too). (PSA)

- The breakdown of a deal by major FCA shareholder Exor to sell an insurance unit, after the prospective buyer tried to negotiate a price reduction, was seen by some as a warning to PSA not to re-open the merger valuation. (Reuters)

- Renault’s forthcoming all-electric SUVs will be sleeker than conventionally powered vehicles because the brand hopes to harness aerodynamics to improve range. (Autocar)

- Reportedly taking an axe to the large car product plan with replacements for the Espace, Tailsman and Scénic apparently cancelled with only one or two years to go until launch. (Reuters)

Subaru

- Subaru reported full fiscal year revenue of 3.3 trillion JPY (about $31 billion), up 6% versus prior year on sales of 1.03 million units, up 3.3%. Operating profit of 210 billion JPY (about $2 billion) rose 15.7%. Subaru is expecting a bumpy year ahead and refused to provide guidance. (Subaru)

- CATL’s CEO says Tesla has a firm plan to make its own batteries. (Inside EVs)

- Reported full year (April 2019 to March 2020) financial results. Sales of 8.958 million units was a whisker below the prior year. Revenue of 30 trillion JPY (about $274 billion) dropped (1)% versus prior year whilst operating income of 2.4 trillion JPY (about $22 billion) was also (1)% worse than prior year. Although the results weren’t much affected by coronavirus, Toyota thinks the current fiscal year will be much worse, predicting that sales will fall by almost 2 million units to around 7 million. (Toyota)

- Announced a series of down days at plants in Japan in response to falling demand. (Toyota)

- Toyota AI Ventures invested in animation company Ziva Dynamics. (FINSMES)

- Suffering problems launching the Golf 8 (and some sister products) because of faults with the equipment used to send notifications to emergency services when the vehicle has an accident. (Handelsblatt)

- VW’s China team say customers are returning to market more quickly than they initially expected but also believe that many domestic brands will fall by the wayside as the industry recovers. (China Daily)

- It sounds like an April Fool’s joke; VW’s ItalDesign is working with Bosch and a company called EasyRain to develop a system that combats aquaplaning in wet weather by squirting water from the car at the water on the road thereby clearing some of the road surface and enabling the vehicle to grip better. (ItalDesign)

Other

- The British government reportedly told McLaren to try harder to raise money rather than asking for aid (beyond the furlough scheme). The company appears willing to mortgage many of its most high-profile assets. (Sky News)

- Mahindra’s Ssangyong brand reported Q1 2020 revenue of €649 billion KRW (about $530 million) and an operating loss of (98.6) billion KRW (about $(80) million), excluding around $(60) million of asset impairments. (Ssangyong)

- Henrik Fisker thinks most electric vehicle start-ups will go bust in two to three years (statistically correct), pointing to likely manufacturing and quality problems and a likely lack of patience from customers for such errors. He did not explain why his, eponymous, firm would be different. (Business Insider)

- Dyson showed off the electric car it had worked so hard on before canning the project last year. The 5 metre long, 7 seat SUV would have put the company squarely up against the likes of Range Rover. A business case that apparently needed (wholesale) revenue of £150,000 per unit would suggest volumes in the low thousands. (Engadget)

- WM Motor unveiled an all-electric concept car called Maven. (Inside EVs)

- Aston Martin reported Q1 2020 financial results. Sales of 578 units dropped (45)% on a year-over-year basis with massive declines in all regions apart from the UK. Aston Martin said this was a conscious effort to reduce dealer stocks and move to build to order. Revenue of £79 million was smaller than the before tax loss of £(119) million. In the earnings call, Aston Martin confirmed that there had been some cancellations for the brand’s limited series, very expensive, “specials”. Although company representatives quickly pointed out that the cancellations had been swiftly placed with other customers, it may be an early indication of softening in this hitherto highly profitable segment. (Aston Martin)

News about other companies and trends

- China light vehicle sales in April of 2.07 million units rose 4.4% year over year with a 31.6% increase in commercial vehicles offsetting a small drop in passenger cars. (CAAM)

- European sales of battery electric and plug-in hybrid vehicles in Q1 2020 represented 6.8% of all passenger cars, up from only 2.5% in the prior year. (ACEA)

Suppliers

- Administrators were called into the UK operations of supplier Arlington Automotive. (BBC)

- Experts believe that hygiene is the next frontier in automotive interior technologies, with UV lights and disinfectants mentioned as potential advances. (Detroit Free Press)

- Martinrea reported Q1 2020 revenue of $873 million and operating income of $49 million. (Martinrea)

Dealers

- Over 40% of UK dealers responding to a survey said they had already made redundancies, in addition to furloughing staff. (Automotive Manager)

Ride-Hailing, Car Sharing & Rental (history)

- Chinese ride hailing firm Shouqi Limousine says it is profitable (on a gross profit basis) in China overall and in several different cities. The company expects positive EBITDA by the end of the year. (Shouqi)

- Lyft is raising $650 million – $750 million of unsecured debt. (Lyft)

- Uber raised $900 million of debt. (Uber)

- Hertz reported a net loss of $(356) million in Q1 2020 and confirmed that it was reliant on the patience of debt holders to remain afloat. (Hertz)

- Uber is reportedly looking to acquire food delivery firm GrubHub. (WSJ)

Driverless / Autonomy (history)

- Waymo’s massive funding round continued to gain momentum: the self-driving developer got its hands on another $750 million, taking the total to $3 billion. (Reuters)

- GM laid off about 8% of staff at the Cruise self-driving unit, despite indicating that spending would be ring-fenced. GM’s CEO said the cuts were “prudent”, focused on non-technical areas and called the company’s commitment to the business “unwavering”. (Reuters)

- Electric powertrain supplier IRP Systems raised $17 million. (IRP)

- Kia will offer electric cars with either 400V (standard today) or 800V (Porsche Taycan) charging capability. The model-by-model decision will be based on Kia’s view of the usage profile. (Kia)

- Charging company Wallbox raised an additional $13 million. (Wallbox)

- Triggo’s forthcoming electric quadricycle can retract the front wheels to make it narrower. (Triggo)

- Lordstown Motors licenced the in-wheel motor technology of Elaphe for inhouse manufacture. (Detroit News)

Connectivity

- European manufacturers’ body ACEA is worried that draft rules about data privacy for connected cars could be overly restrictive around data gathering, especially information from sensors looking outside the cabin. (ACEA)

Other

- Electrically assisted bicycle maker VanMoof raised €12.5 million. (EU Startups)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 10th May 2020

Rental companies confirm they aren’t buying; FCA’s rotten performance; and upper or lower for lidar? Please enjoy our auto industry and mobility briefing for 4th May to 10th May 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Get Get Down — Rental firms are slamming the brakes on new vehicle purchases. I know I raised similar questions last week, but now there are more specifics: Hertz have said they have enough stock to last the rest of 2020 and US OEMs are reportedly trying to reallocate units that rental companies had already agreed to buy. A poorly-kept industry secret is that rental companies often buy more cars and vans than they need because manufacturers give them such massive incentives. Why? For no better reason than it helps underpin market shares, especially when you need to sell lots of cars in a hurry to meet your monthly sales target. Can automakers cope with rental demand dwindling or is it about to blow a hole in production forecasts?

- Bad Apple!! — Fiat Chrysler’s latest financial results hit the headlines due to the €(1.7) billion net loss but the detail hid plenty of scary detail. Specifically, the operations outside of the Americas have cumulatively lost money since Q3 2017. In a world where GM is showing the benefits of brutally culling underperforming areas and we are staring a recession in the face, will big cuts in these regions be the price FCA has to pay to maintain its merger valuation with PSA?

- Up On The Roof — Volvo announced that it will soon be making cars with lidar fitted into the roof, just above the windscreen. The arrangement looks neat, although aerodynamicists might initially have reservations. It is a philosophical departure from the design advanced with Audi where it was mounted in the grille. Are we about to witness a battle between uppers and lowers about which execution is best?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Released financial results for Q1 2020. Automotive revenue of €18.0 billion fell (6.4)% versus Q1 2019 (group revenue rose slightly, thanks to financial services) whilst EBIT of €229 million was much improved versus a loss in the prior year. Although BMW refused to provide a detailed outlook for 2020, the firm still expects for the automotive division to be profitable on an EBIT basis (somewhere between 0% to 3% margin). (BMW)

- Says it will save over €1.7 billion in capital expenditures this year and is confident of meeting European CO2 targets regardless of how the economic situation develops. (BMW)

- Reported Q1 2020 revenue of €20.6 billion, down (16)% year-over-year, and a net loss of €(1.7) billion from continuing operations (which included €643 million of asset impairments). Even using FCA’s preferred “adjusted” EBIT measure, operations outside the America’s have cumulatively lost over €(200) million since Q3 2017. Maserati’s €(444) million of losses in the last 12 months — a stonking (32)% of revenue — raise questions over FCA’s earlier financial allocation methods that made the brand’s performance look so rosy. (FCA)

- Significance: The weak performance in Europe and Asia highlight how much FCA needs the PSA deal to pass. Without it, a politically unpalatable restructuring beckons.

Ferrari

- Ferrari shipped 2,738 units in Q1 2020, up 5% on prior year despite closing the factory in the middle of March. Revenue of €932 million fell (1)%, blamed mostly on F1, whilst EBIT of €220 million fell (5)%. (Ferrari)

- Proclaimed itself “back at full capacity” as of 8th May. (Ferrari)

- Ford’s COO purchased $1 million of Ford stock, in an apparent show of confidence in the recovery. Cynics suggested it was a move aimed at chairman Bill Ford rather than the stock market and that the executive’s pay would soon be increased to refund the move. (AutoExtremist)

- Releasing a package of data collected from self-driving test vehicles roaming the streets of Michigan, USA. Ford says the information is notable because it centres on the same routes over time and therefore allows third party researchers to explore the effects of changes in the local environment, and even sensor crossover when one or more of the cars was in the same location. (Ford)

Geely (includes Volvo) (history)

- Volvo will use a roof mounted Luminar lidar on forthcoming SAE L3 to L4 self-driving features (“fully autonomous highway driving”). Volvo provided an image of how such an integrated system might look, without commenting on possible aerodynamic drawbacks that have led to others mounting similar units in the grille. Volvo has an option to increase its stake in Luminar and expressed a vague aspiration to fit lidar as standard to vehicles on its next-generation platform (implying a ~2025 timeframe and lower specification unit). (Volvo)

- Reported Q1 2020 revenue of $32.7 billion, down (6.2)% on a year-over-year basis, and net income of $294 million, down (86.7)% versus 2019. The company said it was imposing cost cuts, whilst protecting spending on “key franchises”, GM-speak for high margin SUVs and future state bets (electric cars and autonomy). (GM)

- Raised another $4 billion in secured debt and expects a further $2 billion credit facility to be formalised soon. GM is paying an interest rate of 5.4% – 6.8%, much lower than Ford’s recent, similar, offering. (GM)

- Hyundai appears over-pleased with its in-house transmission engineering expertise, claiming (wrongly) that it is uncommon for car manufacturers to make their own and using language that suggests the business still views the product as a significant competitive advantage. (Hyundai)

- Significance: As long-time readers will recall seeing on many occasions, Ad Punctum’s analysis is that many manufacturers are already in a position where commoditising the transmission (and the engine) by sharing with third parties is an overdue step. The transmission is especially vulnerable because even if the world adopts plug-in hybrids more readily than fully electric vehicles, these use a transmission different to most conventional vehicles (and for series hybrids, it can be far simpler). Thus, transmission assets are likely to become a millstone around the neck of manufacturers who persevere with them.

Nissan and Mitsubishi (history)

- Nissan reportedly plans to focus only on Japan, North America and China, with slimmed-down portfolios in European markets. (Reuters)

- Opel lost a series of employment cases brought by disgruntled German engineers who had refused to switch to engineering services provider Segula when Opel offloaded much of its Rüsselsheim product development centre to the French firm. (FAZ)

- Moves to restart production at the Sandouville, France, plant hit trouble when unions won a court judgement saying that safety measures were unclear. (Reuters)

- JLR’s InMotion VC team shared their thoughts on how investments by OEMs can help reduce the environmental impacts of the cars they build. (JLR)

- CEO Musk said, because of local government rules forcing Tesla’s Fremont factory to stay closed, he would move the businesses headquarters and future programs to locations in Texas and Nevada “immediately” and that the site’s future was in peril. It was not clear how the company would carry out such a move logistically, or whether this was a board-approved tweet. (BBC)

- Škoda’s new Enyaq all-electric SUV was unveiled (in camouflage at least). (Škoda)

- Škoda says that it lost 100,000 vehicles in Q1 2020 because of coronavirus. (Škoda)

- Volkswagen is going to own the buildings used by the battery-making joint venture the company has formed with Northvolt. (VW)

- Audi plans to train all sales and service staff about the new A3 using digital tools, foregoing the normal method of delivering train-the-trainer sessions in person. (Audi)

- Audi says it cannot get SAE L3 self-driving features working in the A8, despite saying at the car’s launch that it was only a matter of time until legislative problems were resolved. (Automotive News)

News about other companies and trends

Economic / Political News

- April US light vehicle SAAR of 8.58 million units fell (48)% from prior year. (Wards)

- French passenger car registrations of 20,997 units fell (89)% versus 2019. (CCFA)

- German registrations of 120,840 passenger cars in April, down (61)% versus prior year. (KBA)

- Italian passenger car sales of 4,279 units in April fell (98)% on a year-over-year basis. (UNRAE)

- Spanish passenger car registrations in April of 4,163 units dropped (97)% year-over-year. (ANFAC)

- UK April passenger car sales of 4,321 units fell (97)% from prior year. (SMMT)

- Russia’s government plans to pull forward vehicle purchases planned for 2021 and 2022 to support the local automobile industry. (TASS)

- A UK consumer survey suggests plenty of (retail) customers are still planning to buy a car when dealers reopen, with government advice to drive rather than use public transport reckoned to be a big plus. (Motor Trader)

Suppliers

- Lear reported Q1 2020 revenue of $4.5 billion and net income of $76 million. (Lear)

- Delphi’s Q1 2020 revenue was $945 million, with an operating loss of $(20) million. The company said it was on track to be acquired by BorgWarner after resolving a disagreement over Delphi’s use of a credit line. (Delphi)

- BorgWarner reported Q1 2020 revenue of $2.3 billion and EBIT of $186 million. (BorgWarner)

- Adient reported definitive financial results for Q1 2020 (after making a preliminary filing in April). Revenue was $3.5 billion with EBIT of $66 million. (Adient)

- American Axle (AAM) reported Q1 2020 sales of $1.34 billion and a net loss of $(501) million, more than explained by a goodwill impairment of $510 million. (AAM)

- Aptiv reported Q1 2020 revenue of $3.2 billion and adjusted net income of $173 million (excluding the effect of the autonomous technology JV with Hyundai). (Aptiv)

- Tenneco reported Q1 2020 revenue of $3.8 billion and an adjusted net loss of $(26) million. (Tenneco)

- Yazaki is shedding 20% of its Mexican workforce (about 14,500 jobs), suggesting it doesn’t share the rosier predictions for a recovery. (Reuters)

- Magna reported Q1 2020 revenue of $8.7 billion and net income of $261 million. (Magna) The company’s CEO expects consolidation in the supply base but is waiting to see how well the restart goes before making any big moves. Around 200 suppliers are under intensive monitoring because of concerns they are in financial distress. (Motley Fool)

Dealers

- Chinese new and used car sales website Cheheoduo (formerly Guazi.com) raised $200 million. (Deal Street Asia)

Ride-Hailing, Car Sharing & Rental (history)

- Uber reported Q1 2020 financial results. With gross bookings of $15.8 billion, Uber’s take was $3.5 billion, up 14% on a year-over-year basis. The net loss was $(2.9) billion although Uber claims that on an “adjusted EBITDA” basis ride hailing made $581 million in the quarter. The rate of cash burn suggests that, despite a bump in the stock price, Uber needs to do something drastic soon to remain financially stable. (Uber)

- Lyft reported Q1 2020 revenue of $956 million, up 23%, and a net loss of $(398) million. (Lyft)

- Rental firm Hertz is teetering on the edge of bankruptcy, winning a short reprieve for loan repayments due in late April to late May. The company now says it does not think it will need any new cars in 2020. (Reuters)

- Rental businesses in the USA have reportedly slammed the brakes on new car purchases with various OEMs rumoured to be trying to reallocate stock, with FCA apparently hawking a list of 30,000 vehicles. (Bloomberg)

- Confirming earlier rumours, Intel bought Moovit for $900 million. (Intel)

- Uber invested in scooter rental firm Lime’s $170 million round, handing over Jump (Lime’s smaller rival owned by Uber). Although the move to shed scooter services might appear contrary to Uber’s earlier praise of the vehicles, it would be explained by a reportedly secret pact giving Uber an option to buy Lime. (TechCrunch)

- Investors are betting that massive increases in unemployment will see more people turning their hand to driving using apps like Lyft and Uber with the resulting supply increases allowing the companies to scale down on expensive driver incentives, whilst increasing revenue. It remains unclear whether this view is consistent with existing complaints by full time drivers that revenues in mature markets were barely keeping pace with costs. (Reuters)

- As rumoured, Uber announced plans to make 3,700 employees redundant, with about one third of the job losses coming in Egypt and Dubai (Careem). (Reuters)

Driverless / Autonomy (history)

- Continental says that deferring investments in autonomous technology by a few months won’t hurt. (Reuters)

- Magna’s CEO thinks car companies will reduce spending on SAE L3 to L5 autonomous features but investment in driver assistance (up to L2) will be unaffected. He also implied that Magna and Waymo have held substantive discussions about making complete (white label) vehicles for the self-driving company (Motley Fool)

- Ford is releasing a package of data collected from self-driving test vehicles roaming the streets of Michigan, USA. Ford says the information is notable because it centres on the same routes over time and therefore allows third party researchers to explore the effects of changes in the local environment, and even sensor crossover when one or more of the cars was in the same location. (Ford)

- Volvo will use a roof mounted Luminar lidar on forthcoming SAE L3 to L4 self-driving features (“fully autonomous highway driving”). Volvo provided an image of how such an integrated system might look, without commenting on possible aerodynamic drawbacks that have led to others mounting similar units in the grille. Volvo has an option to increase its stake in Luminar and expressed a vague aspiration to fit lidar as standard to vehicles on its next-generation platform (suggesting a ~2025 timeframe and lower specification unit). (Volvo)

- Audi says it cannot get SAE L3 self-driving features working in the A8, despite saying at the car’s launch that it was only a matter of time until legislative problems were resolved. (Automotive News)

Other

- Google pulled the plug on a plan to build smart technology into a neighbourhood in Toronto, Canada, that is being redeveloped. (Reuters)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 3rd May 2020

A good time for bad news; big spenders tightening their belts; and capital allocation choices looming. Please enjoy our auto industry and mobility briefing for 27th April to 3rd May 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Wrecking Ball — Volvo is slashing salaried staff. Although the company suggests that the cuts were planned, and maybe they were, it reinforces the impression that the coronavirus hiatus (albeit minimised in Sweden) affords the opportunity to make big moves with less downside than might usually be seen. Which other manufacturers will be telling people they don’t need to bother returning to work?

- We Can’t Stop — After Hertz announced a round of layoffs last week, Enterprise, Lyft and (probably) Uber are doing the same. If the companies that, directly or otherwise, drive lots of new car sales are shedding staff, and therefore capacity, what makes manufacturers expect a quick rebound in demand?

- The Climb — The head of VW’s Traton truck unit thinks investments in self-driving will be the first to be thrown overboard as companies clamp down on spending. It makes sense in a way: the pay-off is probably further away than other deserving projects. But there could be a big flaw, and it’s the same one that started the splurge in the first place; if Google (Waymo) can afford to keep spending, those without a serious skin in the game risk being left behind. Does everyone know enough to decide how to trim spending?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Chart of the week

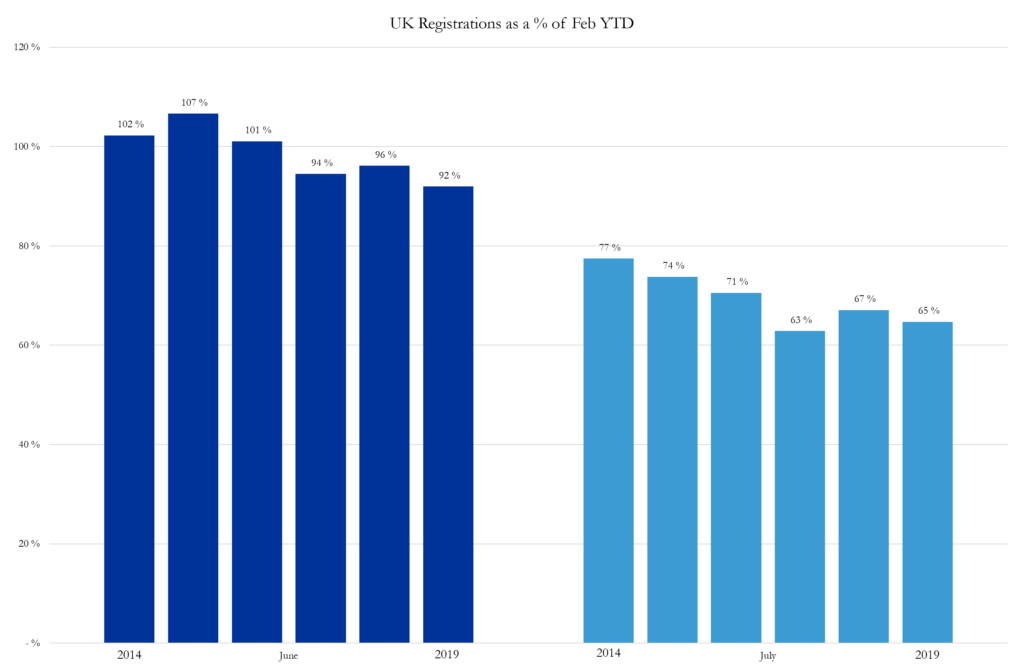

A (unsurprisingly) common theme in discussions we’ve had recently is what consumer reaction we can expect to relaxation of quarantine measures. This particular talking point has been getting good traction so I thought we would share a little insight: Sales in the UK are highly seasonal — reliably higher or lower than other months — driven by the two number plate changes in March and September (where the different number on the plate highlights that the car is brand new).

The chart below shows the recent trend of sales in June and July versus the combined January and February sales in the same year. Not an exact science, but it does provide some idea of a “normal” range when service resumes. If you do the rest of the maths it suggests a June figure in the range 210,000 – 240,000 and July registrations of 145,000 – 175,000 would be consistent with industry recovery. Our key belief is that future state scenarios need to be supplemented by early indicators to enable fine tuning of plans.

News about the major automakers

- Although most of BMW’s workforce buzzed off once coronavirus set in, the bees at Rolls-Royce remained hard at work and managers say they are set for bumper volumes. No word yet on whether Bentley’s hives at Crewe have been similarly unaffected. (Rolls-Royce)

- Reported Q1 2020 revenue of €37.2 billion, down (6)% on a year-over-year basis. EBIT of €617 million fell (78)% from prior year. The 2020 full year outlook amounted to not much more than an expectation to burn cash. (Daimler)

- Reported Q1 2020 financial results. Wholesales of 1,126 units fell (21)% on a year-over-year basis. Automotive revenue of $31.3 billion fell (16)% and there was an EBIT loss of $(177) million. Ford now thinks it has enough money to last to the end of the year, even if it doesn’t sell any more vehicles. The CFO still isn’t confident enough of the financial environment to give a view on full year results but said the company will lose around $(5) billion in the second quarter. Ford Credit made massive reserves for additional expected credit losses and sees residual values dropping towards the end of the year. (Ford)

- Ford has pushed back the launch of self-driving vehicles to 2022. (Ford)

- On the earnings call, Ford’s CFO said he thinks that it will be difficult to trust US used vehicle auction prices for some time after they re-open because of low volumes. (Ford)

- The joint program for a Lincoln vehicle based on Rivian’s platform has been cancelled. (Ford)

- Issued a recall for a small number of US vehicles after dealers, anxious to fix vehicles quickly in the face of a supply backlog, ordered grey market headlamp parts that don’t comply with US regulations. (Ford)

- Ford’s board seat at Rivian was taken by Chairman Bill Ford’s daughter (a director in the corporate strategy department). (Detroit Free Press)

- Significance: The appointment would usually be some way above her (current) pay grade, and points to a desire to quickly accrue experience. Memo: her father became company chairman in his early 40s.

Geely (includes Volvo) (history)

- Sacking 1,300 non-manufacturing staff in Sweden as part of Volvo’s cost-cutting drive. The firm says that the move is in line with existing plans but coronavirus increased the “pertinence” of the steps. (Volvo)

- Kandi Technologies reported full year 2019 revenue of $136 million and operating income of $0.9 million. (Kandi)

- Says that the (limited hands-off driving assistance system) SuperCruise-enabled fleet logs around 70,000 miles per week. (Detroit Free Press)

- Produced 950,393 cars in Q1 2020, down (29)% versus the same period in 2019. (Honda)

- Invested in glass technology developer Gauzy. (i24)

Mazda

- Sold 313,116 cars in Q1 2020, down (20)% year-over-year. (Mazda)

Nissan and Mitsubishi (history)

- Nissan issued a profit warning saying its fiscal full year net loss could be $885 million and that it was delaying financial reporting until late May, at which time it will also announce a recovery plan. (Nissan)

- Connected vehicle data company Otonomo raised $46 million from investors including the Renault-Nissan-Mitsubishi VC unit. (Otonomo)

- Renault reportedly hopes that thinning the heard of contracted engineering services will save €100 million to €200 million per year with a mooted cut from around 15 major suppliers to four or five on the cards. (Reuters)

- Connected vehicle data company Otonomo raised $46 million from investors including the Renault-Nissan-Mitsubishi VC unit. (Otonomo)

- The EU cleared a plan for France to give Renault a €5 billion loan guarantee. (Reuters)

Subaru

- Global production of 270,535 cars rose 19.2% on a year-over-year basis. (Subaru)

Suzuki

- Sold 691,801 units in Q1 2020 (including Maruti-Suzuki in India), (18)% down on 2019. (Suzuki)

- Reported Q1 2020 financial results. Automotive revenue of $5.1 billion rose 38% versus prior year whilst the operating profit of $283 million substantially improved on a loss of $(522) million in 2019. (Tesla)

- Tesla codebreaking sleuths reckon that the latest software updates include a facility for full self-driving to be activated on a pay-as-you-go basis. (CleanTechnica) CEO Musk said in the earnings call that subscription will be an option. (Seeking Alpha)

- Manufacturing costs in China are already below those of the Fremont, USA, factory, per CFO Kirkhorn. Tesla also said that Model Y was already profitable (on the company’s chosen measure of gross margin). (Seeking Alpha)

- CEO Musk tweeted that the share price was too high, sending it lower. (Wired)

- Applied for a licence to sell electricity in the UK, prompting speculation that plans for a large battery installation could be in the works. (BBC)

- Sold 1.7 million vehicles in Q1 2020 (including the Daihatsu and Hino brands), down (12.4)% versus 2019. (Toyota)

- Restructuring the Chinese joint venture with FAW to simplify reporting relationships. (Toyota)

- Announced a series of management changes, primarily reflecting the hand over of the electronics components business to Denso. (Toyota)

- VW Group’s Q1 2020 revenue of €55 billion fell (8.3)% versus prior year and operating profit of €0.9 billion was (81.4)% worse. Deliveries of 2.0 million units fell (25)%. The firm says that it will still make a profit in 2020 even though revenue will be way down over prior year and will probably be cashflow negative. (VW)

- Bentley’s boss says there have been very few cancellations because of coronavirus and production will start at a 50% rate so that there are sufficient gaps between workstations. (Autocar)

- Audi said that a period of coronavirus-enforced reflection has led it to the conclusion that it should pull out of German touring cars to concentrate on the all-electric Formula E series. (Audi)

- The head of the Traton truck unit reckons investments in autonomous technology will be first on the chopping block as companies look to defer spending. (Reuters)

- Significance: Whilst autonomous driving may seem an obvious candidate for spending reductions, given the payoff is longer term, one competitor looks set to continue unabated: Google / Waymo.

Other

- Nio announced a plan to sell 24% of its Chinese business to an assortment of regional government investment vehicles in return for a cash injection of 7 billion RMB (almost $1 billion). (Nio)

- Kenon sold 12% of Qoros (it kept the same amount) to Baoneng (which now holds 63%). (Kenon)

News about other companies and trends

Suppliers

- Visteon reported Q1 2020 revenue of $643 million and a net loss of $(35) million. (Visteon)

- Michelin reported Q1 2020 revenue of €5.3 billion (of which automotive €2.6 billion). (Michelin)

- Continental reported better Q1 2020 financial results than its profit warning suggested. (Continental) The firm won’t be pressing ahead with the spin-off of powertrain arm Vitesco just yet. (Continental)

- Meritor reported Q1 2020 revenue of $871 million and adjusted income of $56 million. (Meritor)

- Goodyear’s Q1 2020 revenue was $3.1 billion, the firm had a net loss of $(619) million. (Goodyear)

- Eaton’s revenue for Q1 2020 was $4.8 billion, and operating profit was $758 million. (Eaton)

- LG’s vehicle electronics division reported Q1 2020 revenue of $1.1 billion and an operating loss of $82 million. (LG)

- LG Chem’s battery business revenue fell quarter over quarter but the company still expects full year increases as industry growth offsets coronavirus-related production losses. (LG Chem)

- Nidec reported full year (April 2019 – March 2020) revenue of 1.5 trillion JPY (about $14.4 billion). Operating profit was 110 billion JPY (about $1 billion). (Nidec)

- Denso reported fiscal full year revenue of $47.6 billion and operating profit of $564 million. (Denso)

Dealers

- A UK survey of potential car buyers found that although 82% were still planning to go ahead with a deal, 76% do not want to go to a dealership in person but only 7% were happy with buying online. (Motor Trader)

- Auto Service Finance, a white label provider of loans for car servicing raised £14 million. (FINSMES)

- Companies such as Morgan (Morgan), Tata (Tata) and VW (VW) announced that warranties would be extended by three months for customers affected by coronavirus shutdowns.

Ride-Hailing, Car Sharing & Rental (history)

- Intel is rumoured to be about to buy multi-modal app Moovit. (Reuters)

- Lyft is shedding 17% of its workforce. (Lyft)

- Uber is rumoured to be mulling a plan to cut 20% of its workforce. (The Information)

- Following in Hertz’s footsteps, Enterprise laid off 2,000 employees in a move the company “expects” will be permanent. (Auto Rental News)

Driverless / Autonomy (history)

- Machine learning firm Tecton.ai, founded by three Uber alumni, raised $20 million. (TechCrunch)

- Self-driving truck start-up Inceptio raised $100 million. (Reuters)

- The head of VW’s Traton truck unit reckons investments in autonomous technology will be first on the chopping block as companies look to defer spending. (Reuters)

- Ford has pushed back the launch of self-driving vehicles to 2022. (Ford)

- Charging network Amply Power raised $13 million. (TechCrunch)

- Battery developer ZAF Energy Systems raised $22 million. (FINSMES)

Connectivity

- Connected services company Automatic, makers of a cheap dongle containing a modem that plugged into a car’s OBDII port and transferred location and other data to the cloud, said it was closing. (Automatic)

- Significance: Since the company’s offering was pretty cheap, yet capable, Automatic’s failure calls into question OEM hopes of monetising similar services, implying that margins are unsustainably thin. Equally, if companies really believe in the value of data then Automatic’s husk could provide rich pickings at a cheap price.

- Connected vehicle data company Otonomo raised $46 million from investors including the Renault-Nissan-Mitsubishi VC unit. (Otonomo)

Other

- Road quality monitoring service Nexar raised $52 million. (Fortune)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 26th April 2020

Oil prices can’t kill the electric car; Madoff-style car companies; and dodgy maths by volume forecasters. Please enjoy our auto industry and mobility briefing for 20th April to 26th April 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- These Are The Days Of Our Lives — Oil prices fell into negative territory. Briefly. In some parts of the world. It isn’t clear whether, or to what extent, this will filter through to prices at the pump but this much is obvious: if electric cars can gain ground under these economic conditions, imagine what will happen if there is a big price rise. There isn’t yet a widely accepted rule of thumb for X% increase in electric fleet mix with $Y increase in the price of a barrel of oil, will there be soon?

- The Invisible Man — A well-placed insider claims that Karma, the electric car company formed from the remnants of (the first) Fisker, is doomed for the scrapheap and peddling vapourware-laden press releases to try and drum up investor interest (which the firm denies). Given that Karma actually produce a car (albeit a legacy design), how well will less mature rivals face down similar claims?

- Hammer To Fall — VW says that when production resumes, some factories will run at 40% of normal rate due to new workplace spacing and hygiene rules. FCA has a slightly sunnier view, aiming for 70%. But how do these constrained supply-side outputs match with the OEMs’ preferred view of a steady recovery, even if the demand is there? I’m just doing some basic maths here (and putting concerns over financial distress to one side): PSA’s view that the European market would decline 25% in 2020 sounded grim but if you lose two months and then can’t return to full speed, isn’t it optimistic?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Preliminary Q1 2020 group EBIT was €617 million. Daimler burned through €(2.3) billion of cash in the quarter and wouldn’t venture an opinion on full year results except to say that they would be worse than 2019. (Daimler)

- Daimler Trucks and Volvo Trucks intend to form a joint venture for fuel cells with Daimler receiving €600 million in return for contributing its fuel cell IP. (Daimler)

- The JV with Volvo Trucks reflects Daimler’s belief that fuel cells have already lost the battle with batteries and the firm has no plans to produce another fuel cell model. (Automotive News)

- Released its 2019 sustainability report. (Daimler)

- Drew €6.25 billion from its agreed credit lines. (Nasdaq)

- CEO Hackett hopes that door handles and steering wheels of future models will contain antimicrobial properties to prevent transmission of diseases. (Detroit News)

- Decided that developing the powertrain for a new Focus RS would be too expensive. (Autocar)

- Corporate espionage experts looking to get their hands on a Mustang Mach E, and associated technology, had their lives made easier thanks to this helpful guide to which engineers have taken them home during the coronavirus lockdown. (CNN)

- Recalling around 1,400 SUVs because the seat belt sensors might not register the occupant properly. (Ford)

Geely (includes Volvo) (history)

- LEVC invoked a force majeure clause in supplier contracts, enabling the firm to suspend payments. (Sky News)

- Lotus’s boss says a forthcoming entry-level sportscar will be the firm’s last with a combustion engine. (Bloomberg)

- Shuttered the Maven short term car rental service with immediate effect. A relatively short time ago, GM was saying everything was going brilliantly. The firm now says it learned lots. (Detroit Free Press)

- Kia reported Q1 2020 sales of 648,685 cars, down (1.9)% versus prior year. Revenue of 14.6 trillion KRW (about $12 billion) rose 17% year-over-year thanks to exchange rates and mix. Operating profit of 446 billion KRW (about $360 million) fell (25)%. Kia hopes that a new line of SUVs will help offset some of coronavirus. (Kia)

- Hyundai reported Q1 2020 revenue of 25.3 trillion KRW (about $21 billion), up 6% on a year-over-year basis. Operating profit of 864 billion KRW (about $710 million). (Hyundai)

- Recalling vehicles fitted with the remote parking feature because the car might move even when the driver hasn’t asked it to. (Fox)

Nissan and Mitsubishi (history)

- The alliance partners are reportedly planning a slew of new shared programs, with a focus on electric cars and self-driving technology. (Reuters)

- Mitsubishi issued a profit warning for the 2019/20 fiscal year (which just ended). Preliminary revenue is 2.3 trillion JPY (about $21.3 billion) and operating profit is 12 billion JPY (about $112 million). (Mitsubishi)

- Reported Q1 2020 revenue of €15.2 billion. Automotive revenue of €11.9 billion fell (16)% versus prior year. Pricing and production mix gains were more than offset by volume drops. PSA reports full financial figures every six months. The company expects European industry to be 25% lower than 2019 levels but didn’t give a view on 2021. (PSA)

- Faurecia formed a joint venture with Xuyang Group to develop display systems. (Faurecia)

- Reported quarterly revenue of €10.1 billion in Q1 2020, a drop of (19.2)% on a year-over-year basis, from sales of 672,962 vehicles, down (25.9)%. Renault only reports full financial results every six months. Renault said the effects of coronavirus were “impossible to assess”. (Renault)

- Expects to have a multi-billion euro loan, backed by the French state, lined up by the end of May. (Reuters)

- Global wholesales in Q1 2020 (fiscal Q4) were 231,929 units (of which JLR was 126,979 cars), down (35)% on a year-over-year basis. (Tata)

- CEO Musk said that the Cybertruck could float as a method of increasing the wading depth. (Twitter)

- Unveiled a new B-sized crossover for the European market. Rather than tie into the existing crossover nomenclature with B-HR, Toyota opted for Yaris Cross. The car will launch in 2021. (Toyota)

- Škoda says that 2019 options take rate data shows customers really want larger windows. (Škoda)

Other

- Karma says that, thanks to its new platform, it can develop supercars with a 0-60 mph time under two seconds with 400 miles of range, plus 21 other types of car. (Karma) On the other hand, unnamed insiders claim that many of the recent product reveals have been half-baked and the company is about to implement drastic cuts. Karma strenuously denied the claims. (Jalopnik)

- FAW and hitherto little-known start-up Silk EV plan to make a Hongqibranded sports car. (Reuters)

- BYD and Hino will work together on electric commercial vehicles. (Inside EVs)

News about other companies and trends

Economic / Political News

- EU negotiators said that poor progress was being made in post-Brexit trade agreement talks, with part of the problem being that the UK kept insisting it was an equal-strength partner. (BBC)

- European light commercial vehicle sales in Q1 2020 of 422,681 units fell (24.7)% year-over-year. (ACEA)

- The US Government has granted manufacturers five years (from three) to meet the requirements of the renewed NAFTA / USMCA. (Detroit News)

- As European car making plants gingerly restarted production, measures implemented by VW in Germany were typical: temperature checks; greater distance between workstations and freely available hand sanitiser and face masks. Critically, volumes are drastically reduced because of lower employee densities (for instance, in Wolfsburg, even once everyone is back at work, volumes will be only 40% of “normal” levels). (VW)

- Leaders of the UAW union in the US are sceptical that manufacturers know what the right level of preventative measures required are. (Detroit Free Press)

- Oil prices fell into negative territory as traders scrambled to cover futures contracts. It isn’t clear how much this will flow to prices at the pump. (Reuters)

Suppliers

- Veoneer agreed to sell most of its brake control division to a mysterious “well-established automotive supplier”. The deal is expected to close by mid-year. (Veoneer) Q1 2020 revenue was $362 million. (Veoneer)

- Kongsberg’s Q1 2020 revenue was €262 million and adjusted EBIT was €8 million. (Kongsberg)

- Autoliv reported Q1 2020 revenue of $1.8 billion and operating income of $134 million. (Autoliv)

- Adient reported preliminary Q1 2020 revenue of $3.5 billion. (Adient)

- Valeo’s Q1 2020 revenue was €4.5 billion. The firm says it has enough money to pay a dividend. (Valeo)

Ride-Hailing, Car Sharing & Rental (history)

- Uber launched new contactless delivery services to try and make up for the drop in taxi business. Uber Direct is like Uber Eats, but for things that aren’t food. Uber Connect is a peer-to-peer courier service. (Uber)

- Hertz laid off 1,000 staff as part of moves to weather an impending recession. (Auto Rental News)

- GM shuttered the Maven short term car rental service with immediate effect. A relatively short time ago, GM was saying everything was going brilliantly. The firm now says it learned lots. (Detroit Free Press)

Driverless / Autonomy (history)

- Venti Technologies and Aerosun Corporation hope to develop a range of driverless cleaning vehicles. (Venti)

- Portable charger maker SparkCharge raised $3.3 million. (Charged EVs)

- Charger developer FreeWire raised $25 million from BP and others. (FreeWire)

Connectivity

- US car makers, desperate to preserve a radio spectrum reservation, said they would put 5 million connected cars and pieces of roadside infrastructure within the next five years if the government abandoned plans to reallocate most of the capacity to other user groups. (Bloomberg)

Other

- An exposé of scooter rental service Bird’s culture and operations suggested that insiders believe the company is destined to fail (soon). (The Verge)

- Didi Chuxing’s bicycle rental unit Qingju reportedly raised $1 billion, some of it apparently from right under the noses of rival Hellobike. (Technode)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 19th April 2020

Tesla moves further down the road to cast bodies; Ford’s age problem; and you have permission to plan for a recession. Please enjoy our auto industry and mobility briefing for 14th April to 19th April 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Why Stop Now — Tesla is so happy with the use of large castings in the Model Y that plans are afoot to go further and roll back some of the changes to Model 3. The use of castings for the vehicle body is nothing new, but Tesla’s approach to replace assemblies made up of stampings and extrusions with castings far bigger than normal is innovative and makes things simpler (and hopefully cheaper, if you can overcome weight and engineering change problems). Will Tesla now proceed to the completely cast underbody as promised?

- Respect My Conglomerate — Ford celebrated the recruitment of two new executives, one aged 44, the other 36. They are going to work in new-fangled departments like data analytics and digital experience. All well and good, but why doesn’t Ford seem to have any homegrown talent under 45 in senior positions? Could it be that ageing managers have supressed talent? Or, everyone they recruited from school is no good? Will the new recruits stay?

- Extinction Level Event — The head of the IMF is expecting a mega recession, so it’s official: we are allowed to talk about it without fear of being labelled a scare mongering demand destroyer. Kongsberg Automotive (a supplier) thinks that even in the best case, global industry will fall around 10% in 2021 (and crater in 2020). Which OEMs will be the first to openly agree? Will Tesla and Uber survive?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Released its annual sustainability report. (FCA)

- Recalling 425,588 vehicles to fix windscreen wipers that might fall off. (FCA)

- Prompted by an intensive study led by new COO Farley, Ford announced an executive reshuffle: The head of the Americas will now run all markets except China and Europe, receiving extra help from a new North America COO and an expanded role for the leader of the South America unit. The head of Ford’s much-vaunted Team Edison electric car project will run commercial vehicles in North America, without a clear replacement. Two lower-tier external recruitments were made in data analytics and digital experiences. (Ford)

- Significance: Ford’s external recruitment highlights the firm’s dearth of under 45s with significant leadership experience, perhaps in part explaining the tardiness on upgrading the portfolio for electrification and connectivity. The last major hire at a similar age didn’t fare too well, leaving relatively quickly citing an unease with the company’s culture.

- Raised $8 billion in bonds that mature between 2023 – 2030. Analysts noted the high interest rates — 9.625% for the longest-dated debt. (Ford)

- Raised an additional $1.95 billion credit line. GM said it would only be used for the captive finance company (although the terms aren’t so prescriptive). (GM)

- PSA’s Q1 sales of 627,024 vehicles fell (29)% on a year-over-year basis. (PSA)

- JLR’s fiscal full year (April 2019 to March 2020) retail sales of 508,659 units fell (12)% year-over-year. (JLR)

- CEO Musk says the use of large castings to replace traditional stampings in the Model Y subframe had been so successful that the company is going forward with a plan to replace components with even bigger castings, and to roll some of the changes into the Model 3, but not for some time. (Clean Technica)

- Announced preliminary financial results for Q1 2020. Revenue was around €55 billion, with an operating profit of €0.9 billion with VW saying it lost €(1.3) billion on commodity and currency hedging. Cash flow was €(2.5) billion. Financial guidance for the full year was withdrawn. (VW)

- Bugatti engineers say that working restrictions in place to prevent virus transmission have led to a 30% increase in the time it takes to complete calibration drives but they are still having fun. (VW)

News about other companies and trends

Economic / Political News

- The recently appointed head of the IMF expects a massive global recession to follow coronavirus. (BBC)

- French president Macron believes that people will want to push harder on clean air and climate change related regulations. (FT)

- European passenger car registrations in March of 853,077 units fell (52)% on a year-over-year basis. (ACEA)

- European car makers trade body ACEA explicitly called for a financial stimulus to encourage “fleet renewal” by customers who might otherwise keep their cars. (ACEA)

Suppliers

- Motherson says customer (OEMs) are suggesting financially distressed suppliers as potential takeover targets and it will share some plans in October. (Autocar)

- Tenneco has outsourced some engine components that it (or previously Federal Mogul) traditionally supplied to Burgess Norton. It is unclear whether any asset transfer is involved. (Burgess Norton)

- Bharat Forge thinks that as a result of coronavirus, OEMs are more likely to diversify their supply bases so that they are better placed to weather similar shocks in future. (Autocar)

- Endurance Technologies acquired Italian clutch specialist Adler. (Endurance)

- Michelin took a 20% stake in recycling company Enviro, developers of a promising process that can break down used tyres to their constituent raw materials. (Michelin)

- TomTom reported Q1 2020 revenue of €131 million and a net loss of €(63) million. (TomTom)

- Kongsberg’s worst-case scenario for a coronavirus recovery is that factories restart en masse in May but take until mid-July to get up to normal speed. Even in the company’s best case, in 2021 industry would be (9)% – (11)% worse than 2019. (Kongsberg p.13)

- Goodyear issued preliminary Q1 2020 financial results. Revenue was $3 billion and the PBT loss will be in the range $(185) million to $(195) million. (Goodyear)

Dealers

- Mazda started giving quotes for bodywork repair based on photographs uploaded by the owner. (Mazda)

Ride-Hailing, Car Sharing & Rental (history)

- BMW and Daimler’s FREE NOW ride hailing service absorbed Kapten. (Kapten)

- Fleet management software developer Autofleet raised $7.5 million. (FINSMES)

- Uber says coronavirus has caused a write down of investments in other companies totalling around $2 billion. (Uber)

Driverless / Autonomy (history)

- Zoox and Tesla settled a lawsuit over documentation (about parts ordering and how to run a warehouse) ex-Tesla employees had taken with them when they joined the self-driving start-up. (The Verge)

- APB Corporation licenced Nissan’s battery technology for use in stationary storage applications. (Autocar)

- Significance: With stationary storage producers (obviously) looking to use the most up to date technology, it remains to be seen how much revenue used batteries will capture when in direct competition with brand new products.

Other

- Lime acquired the remnants of electric skateboard maker Boosted. (The Verge)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 13th April 2020

Easily fixed warranty problems; outrageous ideas about solar power; and a good excuse for sensible ideas. Please enjoy our auto industry and mobility briefing for 6th April to 13th April 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- What Goes Around… Comes Around… — FCA is recalling about 320,000 vehicles because the rear-view camera video lingers too long in the display after the driver selects a forward gear. Apparently, this can be distracting and cause crashes. What I’m wondering is why (years after Tesla blazed a trail for over the air updates and mainstream manufacturers connected their infotainment systems to the cloud) the control of the rear view camera image is considered such a security risk that this repair requires a visit to the dealer?

- SexyBack — Flexible solar panel maker Armor thinks that the secret to covering a car in solar panels without ruining the styling is using a retractable cover stored in the rear bumper. First off, apologies, this was unveiled in February so for some won’t count as new news. Some will point to inefficiencies in using flexible cells, plus the fact that the system can’t charge whilst the car is driving. I’m drawn to the slightly bonkers, out-of-the-box, feeling of it all. Are we all being so imaginative?

- Not A Bad Thing — Aston Martin wants to use the coronavirus to shift from build to schedule (where the factory and dealers decide what cars people will probably want) to build to order (where a customer needs to order the car first). Why don’t car makers only build the cars people have paid for anyway, you might think? I’m afraid the answer to that lies in arcane practices around production levelling and supply base planning that make build to order harder than it sounds. But Aston are far from the only company that works this way; will the period of coronavirus-enforced reflection prompt others to go the same way?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Delivered 477,111 cars in Q1 2020, down (21)% versus prior year. (BMW)

- Delivered 483,241 passenger cars in Q1 2020, a drop of (18)% on a year-over-year basis. (Daimler)

- Daimler’s CFO got the backs of the finance staff up by announcing a reorganisation (a combination of the corporate Daimler and car making finance teams) but withholding details until after the coronavirus passes. Insiders reportedly believe that this is the first step in a push to eliminate most of the 6,000 positions at the group holding company, citing massive duplication with Mercedes-Benz. (Handelsblatt)

- CFO Wilhelm said that passenger car and van divisions will make a Q1 2020 profit, despite coronavirus. (Reuters)

- PSA and FCA are working hard to close their merger agreement ahead of schedule. (Reuters)

- Recalling about 320,000 vehicles because the display from the rear view camera doesn’t disappear quickly enough once drivers start moving forward. (UPI)

- Significance: This is exactly the type of fault that manufacturers should be fixing quickly and cheaply with over the air updates.

- Issued a profit warning for Q1 2020 results. Revenue will be about $34 billion and adjusted PBIT will be around $(0.6) billion. Ford’s latest net cash figure suggests net cash burn of over $7 billion since the end of 2019. The CFO said the company has enough money for there to be zero production to the end of Q3 2020. (Ford)

- Recalling about 68,000 trucks and large SUVs in North America because of a potential rollaway issue. (Ford)

- Interested in raising even more money to cover potential cash burn. (Bloomberg)

Geely (includes Volvo) (history)

- Geely’s Chinese brands sold 206,027 units in Q1 2020, a (44)% drop on prior year. (Geely)

Nissan and Mitsubishi (history)

- Nissan’s forthcoming recovery plan will reportedly replace a long-standing sales target of around 6 – 7 million vehicles annually with a lower figure of around 5 million. (Reuters)

- Nissan is apparently asking banks for a $4.6 billion increase in its credit line. (Reuters)

- The head of the Vauxhall brand in the UK believes that coronavirus will irrevocably change buying habits, with (retail) customers relying far more on websites and manufacturer call centres for initial enquiries, then being handed over to a dealer. (Autocar)

- PSA and FCA are working hard to close their merger agreement ahead of schedule. (Reuters)

- Announced a new China plan. Renault will sell its shares in Dongfeng Renault to Dongfeng and the company will cease production and sales of Renault branded cars (although existing customers will be looked after). The brand will continue with commercial vehicles and electric cars through three other joint ventures (one of which is with Dongfeng). (Renault)

- Cancelled the 2019 dividend. (Renault)

- S&P downgraded Renault’s corporate bonds to junk (BB+/B). (Reuters)

- Reached a wage agreement with workers at Renault Samsung in South Korea. (Yonhap)

- Hoping to raise an additional €4 billion – €5 billion. (Reuters)

- Toyoda Gosei invested in cloud computing service Uhuru. (Toyoda Gosei)

- Over 60,000 Toyota customers in North America have deferred lease payments as a result of coronavirus. Around one third of Toyota’s dealers have suspended sales. (Toyota)

- Reportedly contemplating withholding the (already promised) €3.3 billion dividend to shore up cash. (Bloomberg)

- Agreed an eight-month contract with German unions to tide everyone over until the worst of coronavirus (hopefully). Pay is frozen but there was some minor adjustment to conditions. (VW)

- Reckons that showroom traffic in Chinese dealers is about the same as this time last year. (VW)

- Creating a joint venture in China with DU-POWER to build charging stations. (VW)

- Created a four stage framework, with unions, for a staged return to normality in factories and offices. (VW)

Other

- Aston Martin plans to use the coronavirus-enforced shutdown to shift to a build to retail order scheduling system, saying that it has worked well so far on DBX, and that it’s how Ferrari do it (although he admits that this will increase waiting times). CEO Palmer also hopes to remain in position until at least 2025. (Autocar)

- McLaren’s CEO reckons that sports car manufacturers will offer a mix of powertrains (electric and traditional) for the next two to three decades. (Autocar) The firm is also hoping that it can help develop synthetic fuels that might make gas-guzzling more palatable (carbon capture issues notwithstanding) but stresses that the technology is only in the early stages of development. (Autocar)

- Mahindra’s boss told managers and union officials at Ssangyong that he wouldn’t abandon the brand but stopped short of offering any more money. (Yonhap)

- Nio delivered 3,838 cars in Q1 2020, a (4)% drop year-over-year, with the start of sales of the ES6 failing to offset seasonality, coronavirus and a drop in the popularity of the ES8. (Nio)

- Karma showed off what the brand claimed was a prototype for a semi-autonomous all-electric van. The vehicle appeared to share much of its styling with a Ram ProMaster, but with much better wheels. (Karma)

- Mazzanti started a crowdfunding campaign, offering 7% of the company if it can raise €300,000. (Mazzanti)

News about other companies and trends

Economic / Political News

- European vehicle manufacturers’ trade body ACEA called for a UK-EU trade agreement that looks almost identical to existing single market rules in almost all respects, with relaxed rules of origin requirements (except for batteries), special customs clearance measures and continuation of regulatory cooperation. There was a meek request for free movement of skilled personnel. (ACEA)

Suppliers

- A BorgWarner plant in Seneca, USA suffered significant damage from a tornado, which killed a security guard. The company said customers would be unaffected (especially since so many are currently closed). (Detroit Free Press)

- Visteon embarked on a fresh job-cutting spree, on top of a program announced in January. (Visteon)

- Bosch has been having trouble restarting production at its factory in Rodez, France. Despite measures proposed by managers to minimise the risk of virus transmission, there is a high rate of absenteeism, apparently partly in protest at plans to wind down the site’s workload in future. (Les Echos)

Driverless / Autonomy (history)

- Autonomous trucking company Einride is experimenting with having a single remote operator monitor and control multiple vehicles at once. (TechCrunch)

- Flexible solar panel maker Armor has come up with a way of integrating lots of solar cells without having to worry too much about the effect on the vehicle’s styling. Instead of being permanently installed, they are part of a retractable cover that emerges from the rear bumper when the car is parked. (Armor)

- Battery developer ProLogium raised $100 million. (Deal Street Asia)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 5th April 2020

Tesla’s opaque reporting; Volvo goes it alone on autonomous; and a big thumbs up for sharing. Please enjoy our auto industry and mobility briefing for 30th March to 5th April 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Nothing To Regret — Tesla reported Q1 deliveries. The numbers were a bit down on the prior quarter, as expected but what I found interesting was the reporting itself. With the launch of Model Y, Tesla has chosen to bundle the new car with the Model 3’s numbers, meaning there isn’t any specific vehicle line detail available. Being fuzzy on sales in normally the preserve of low volume manufacturers or, for the likes of Daimler and BMW, fringe models. Why the lack of transparency?

- Build Me Up Buttercup — Volvo and Veoneer are dissolving their partnership for developing self-driving technologies. Volvo seems rather pleased with its side of the deal, retaining all the advanced driverless bits, but the outcome seems to be going against the grain (which is major manufacturers teaming up). Does Volvo really believe it can make it all alone, or does this only make sense in the context of a merger with Geely?

- Wherever You Will Go — GM will build two new electric cars for Honda in North America. The agreement builds on an earlier deal to share electric powertrain components and shows that GM is open-minded about sharing electric vehicle parts (perhaps partly after looking at VW and Ford). It is also something of a rarity for Honda to borrow someone else’s car (although not unprecedented). Will this move make others take notice?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Believes that in eight to ten years recycled batteries will become a significant source of raw materials and says that solid state batteries won’t be any good for passenger cars, even by the late 2020s, although it does see the technology as suitable for commercial vehicles. (Daimler)

- Negotiated an additional €12 billion credit line. (Reuters)

- US sales of 446,768 units in Q1 2020 fell (10)% from a year earlier. (FCA)

Ferrari

- Stopped share repurchases to conserve cash. (Ferrari)

- Reported Q1 2020 US sales of 516,330 units, (12.5)% down on prior year. (Ford)

- Called for a stimulus to boost demand once coronavirus recedes and thinks that the shutdown has permanently accelerated a move towards online sales, at least in the USA. (Reuters)

- Invested in autonomous driving software provider Phantom AI. (FINSMES)

Geely (includes Volvo) (history)

- Geely reported 2019 full year financial results (excluding Volvo). Revenue of 97.4 billion RMB (about $13.7 billion), down (9)% versus prior year. Net profit of 8.3 billion RMB (about $1.2 billion) fell (35)%, blamed on intense competition in China. (Geely)

- Volvo sold 131,889 cars in Q1 2020, a drop of (31.2)% from prior year. (Volvo)

- Volvo and Veoneer agreed to dissolve the Zenuity driver assistance technology joint venture. Volvo will take on the bits that developed self-driving and Veoneer will get the simpler, but closer to production, L1 – L3 driver assistance technologies. (Veoneer)

- Honda will engineer two new vehicles using GM’s electric vehicle platform, and GM will build the finished products in North America under a deal that strengthens an existing agreement to share battery technology. (Honda)

- Sold 618,335 vehicles in the USA during Q1 2020, down (7)% on a year earlier. (GM)

- Sold 461,716 vehicles in China during Q1 2020, a drop of (43.4)% on prior year. (GM)

- GM’s decision to draw a $16 billion credit line appears to have imperilled discussions aimed at extending and slightly raising the amount on offer. Banks stung by the move are reportedly only willing to negotiate an extension of the credit that is soon to expire, not the full amount. (Reuters)

- Honda will engineer two new vehicles using GM’s electric vehicle platform, and GM will build the finished products in North America under a deal that strengthens an existing agreement to share battery technology. (Honda)

- Hyundai’s Q1 2020 sales were 904,726 units, (11.4)% worse than a year earlier. (Hyundai)

- Kia’s Q1 2020 sales were 644,102 units, a drop of (0.9)% from Q1 2019. (Kia)

- Constructing a new facility in Singapore that will include a pilot plant for electric vehicles and develop an automated production philosophy similar to that proposed by recent investment Arrival. (Business Times)

Mazda

- Toyota’s financial arm started providing leasing deals to US Mazda dealers on a white label basis. (Toyota)

- Negotiated an additional €3 billion credit line. (Reuters)

- Dongfeng said plans to reduce its stake in PSA — a pillar of the PSA / FCA merger plan — were under review following the drop in PSA’s share price. (Reuters)

- Reported Q1 2020 deliveries of 88,400 units, a 40% rise on a year-over-year basis. Production fell (2)% quarter-over-quarter, as the addition of Model Y and the Shanghai plant failed to offset lost production from coronavirus. Tesla stopped reporting Model 3 sales figures independently, combining them with Model Y. (Tesla)

- Created a joint venture to supply electricity from renewable sources to Toyota in Japan. (Toyota)

- Formally established a joint venture with BYD to develop electric vehicle technology. (Toyota)

- Toyota’s financial arm started providing leasing deals to US Mazda dealers on a white label basis. (Toyota)

- Says that in Germany 50% of customers are now ordering all-electric versions of the Up! city car and one in seven Passat sales are for the plug-in hybrid powertrain. (VW)

- Audi has apparently decided not to develop an all-electric version of the A8 and will only offer the car as a plug-in hybrid. (Automotive News)

Other

- Mahindra rejected pleas from South Korean subsidiary Ssangyong for a $400 million cash infusion, saying the brand should find alternative sources, but that it might be prepared to chip in $30 million. (Times of India)

- Despite Nio’s financial troubles, the company’s VC arm invested in Chinese cloud computing provider BoCloud. (China Money Network)

News about other companies and trends

Economic / Political News

- ACEA says 1.1 million workers directly employed by car and truck makers have been laid off as a result of coronavirus, and 1.2 million units have been lost. (ACEA)

- US light vehicle SAAR in March of 11.37 million units fell (35)% on a year-over-year basis. (Wards)

- March passenger car registrations in Germany of 215,119 units fell (37.7)% from prior year. (KBA)

- UK passenger car registrations in March dropped (44)% versus 2019 to 254,684 units. (SMMT)

- Spanish March registrations of 37,644 units fell (69.3)% from a year earlier. (ANFAC)

- Italian passenger car registrations for March of 28,326 units fell (85.4)% from prior year. (UNRAE)

- Passenger car registrations in France during March fell (72.2)% to 62,668 units. (CCFA)

- German car making bosses reportedly warned chancellor Merkel that many suppliers could go to the wall and restarting production will not be easy without all EU countries being given the all clear, due to the spread of the supply base across the economic bloc. (Handelsblatt)

Suppliers

- BorgWarner said Delphi has materially breached the merger agreement by drawing a $500 million credit line. The announcement appeared to be positioning to improve the deal terms. (BorgWarner)

- Nidec bought part of Secop’s non-automotive business. (Nidec)

- Toyoda Gosei is putting all its Indian assets into the joint venture with Minda. (Toyoda Gosei)

- Valmet Automotive’s 2019 FY revenue was €652 million and operating profit was €18 million. (Valmet)

- Volvo and Veoneer agreed to dissolve the Zenuity driver assistance technology joint venture. Volvo will take on the bits that developed self-driving and Veoneer will get the simpler, but closer to production, L1 – L3 driver assistance technologies. The Zenuity brand will continue, but only as a passive IP holding company. (Veoneer)

Dealers

- Ford thinks that the shutdown has permanently accelerated a move towards online sales in the USA. (Reuters)

Ride-Hailing, Car Sharing & Rental (history)

- Ride hailing firm Via says it is worth $2.25 billion after a Series E funding round that included investment by FCA’s controlling shareholder EXOR, which forked out $200 million. (Via)

- Grab appointed a new CFO. (Grab)

Driverless / Autonomy (history)

- Autonomous vehicle simulation firm Qcraft raised $24 million. (VentureBeat)

- Self-driving warehouse robot developer Seegrid raised $25 million. (VentureBeat)

- Lidar firm Quanergy raised an undisclosed amount and appointed a new CEO. (Quanergy)

- Waymo shared a blog post explaining how it creates new images, even lidar point clouds, to improve object identification. (Waymo)

- Yamaha and Tier IV created a joint venture, eve autonomy, to offer autonomous logistics to factories. (Autocar)

- Ford invested in autonomous driving software provider Phantom AI’s $22 million round. (FINSMES)

- Battery technology developer Addionics raised $6 million. (TechCrunch)

- Daimler believes that in eight to ten years recycled batteries will become a significant source of raw materials and says that solid state batteries won’t be any good for passenger cars, even by the late 2020s, although it does see the technology as suitable for commercial vehicles. (Daimler)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 29th March 2020